O wad some Pow’r the giftie gie us. To see oursels as ithers see us! – To a Louse, Robert Burns

It’s that time again. The annual Government Expenditure and Revenue Scotland report is out. Click the link or the image below to read it for yourself.

Actually it seems like only March that the last edition was out. What’s happening here?

Well, there was a consultation that almost no-one knew about which discussed a few methodological changes to GERS in line with the ‘new powers’ we’re getting and it also asked if the next report should be brought forward. I’m completely convinced that the fact that this means that we’re getting the report well before the Council election campaign next year is absolutely just a convenient side effect(!)…but no matter. We’ve got the data.

Tomorrow’s Headline Today

Scotland’s budget deficit remains at a little under £15 billion. As with last year, don’t expect a single news outlet to go one single step further with the story than that. Except maybe to say that oil revenue has dropped from £1.802 billion last year to just £60 million this year.

So what’s happened? Why hasn’t Scotland, which is “totally dependent on oil”, completely collapsed now that oil revenues have basically dropped to zero?

Last year, total revenues dropped by around £500 million on 2013-14. This year, total revenues have INCREASED by £181 million. In fact, total revenue is higher than it was in 2012-13 when we received some £5.3 billion in oil revenue.

It’s also worth noting that if you only look at GERS 2015-16 then it looks like our deficit has increased by a couple of hundred million in the past year but if you look a bit deeper, and compare the numbers to previous GERS reports then something interesting happens.

In GERS 2014-15 our deficit was recorded as £14.8 billion but in GERS 2015-16 the 2014-15 deficit has somehow dropped by £622 million to £14.3 billion. Essentially, this shows one of the limits of GERS in that it is based on sometimes highly speculative estimates which get revised over time. It may be five years before we finally know the “true” accounts figures for this year. This accounting adjustment is extremely significant compared to, say, our “budget underspends” but unless you’ve read it here I expect it to pass entirely unnoticed.

Now, what about our all hallowed GDP? It’s down by 0.45% from £157.502 billion in 2014-15 to £156.784 billion in 2015-16 (with non-oil GDP having increased by over £2.2 billion, the highest it’s ever been).

You know, perhaps it’s time we started measuring our economy in terms other than just GDP. We know it’s flawed. We know it throws up extremely strange results like Ireland’s “economy” growing by 25% because a few American companies moved their nameplates around. We know it doesn’t even particularly correlate to things like tax and ability to service debt very well.

Maybe it’s time we started measuring (and taxing) our country based on the things which actually matter.

But back to GERS.

Dutch Disease with Scottish Characteristics

So what’s going on here? Essentially it’s the same pattern first picked up last year. As oil prices drop, so do fuel costs. Which means everything from the costs of transporting goods to the heating and lighting costs for your home drops. This means you have more money to spend in the economy and companies have fewer overheads leading to either greater profits (thus, ideally, more tax revenue) or more room to invest in expansion.

This is a clear demonstration of the so-called “Dutch Disease” where high oil prices choke off the non-oil based economy in the form of the aforementioned fuel costs (it also tends to harden one’s currency but this is less of a factor in the Scottish case given that we don’t yet have one).

At the time of the last report I was criticised for pointing this out on the grounds that the oil price collapse “hadn’t fully fed through” hence I was jumping the gun on the observation. It shall be interesting to see if anyone says the same thing now. Could revenues drop any lower?

This should serve as somewhat of a warning to those itching for the return of high oil prices and certainly for those desperate to “replace” offshore oil with onshore fracking. It’s maybe time to have a good hard rethink about what kind of resources we want to develop in Scotland. Now, to be sure, I’ve nothing against our offshore industry and for those folk out there it’s been a pretty dreadful time. It’s just that, certainly as a Green, I think our offshore industry is on the wrong side of the country and should be based on wind/wave and tide rather than oil. You can be sure that if the wind and tide stops flowing we’ll be dealing with problems a little bit larger than the state of our finances.

Scotland’s offshore Wind Power Density map

Sweet Fiscal Autonomy

As mentioned earlier, part of the methodological changes discussed in the GERS consultation was to do with looking at the taxes to be devolved to Scotland under the series of “vast, new powers” we’ve been generously granted.

In terms of actual revenue, chief amongst these is income tax (excluding interest and dividends, the ability to move the Personal Allowance or to adjust the definition of “income”) and VAT (excluding any actual control at all. We’re getting the VAT added to Scottish coffers and then an equivalent amount removed from the block grant. Yay.) along with comparatively minor taxes like landfill tax, aggregate levy and air passenger duty.

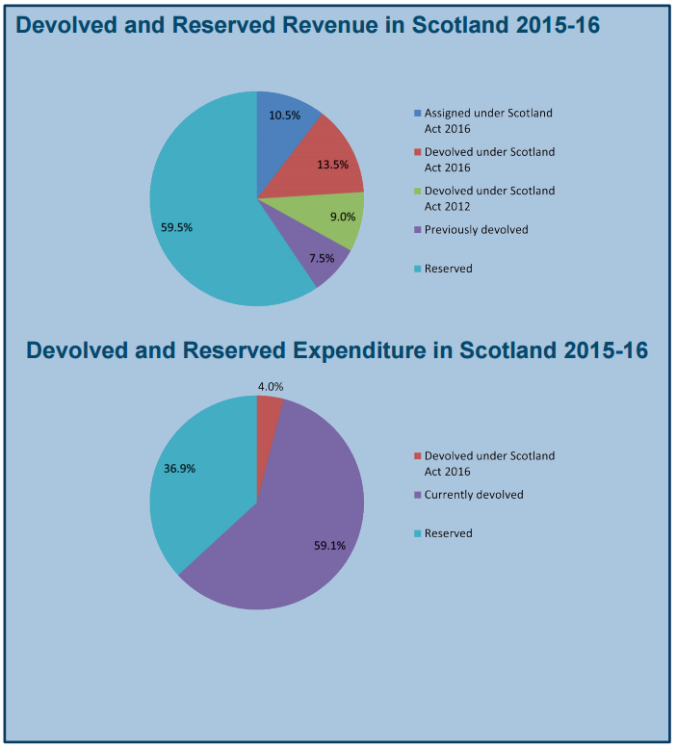

In total, the Scottish government will directly receive 40.5% of Scottish revenue (£21.8 billion this year) and, given the limitations on VAT and income tax, have actual, practical control over perhaps half of that. Devolved expenditure, however, will soon sit at 63.1% of total (£43.3 billion). Basically the Scottish government can only directly control enough income to fund perhaps about a quarter of what it’s directly responsible for delivering.

There’s a side issue in all of this related to that old topic of the budget underspends. Tucked away on page 47 of GERS there’s an interesting line which looks at the confidence intervals for some of the tax revenues used. Remember that the revenues given are estimates and are subject both to revision over time and change due to circumstances that the government cannot control. For example, if you move job half way through the tax year your income, therefore income tax, can change. If your job moves you to England, your entire income tax contribution moves from the Scotland side of the budget to the rUK one. Hence, the total income tax revenue estimate is subject to a margin of error, in this case of 1.0%.

The same goes for other taxes to greater or lesser degree to the effect that the margin of error over all of the taxes measured there is 1.6% or ±£570 million.

Remember that the Scottish Government has extremely limited borrowing powers. It can only “overspend” on the current budget by £200 million in a single year and cannot exceed a total current debt of £500 million. And yet income revenue, on which expenditure must be planned, has a margin of error of ±£570 million.

In the event, this year Scotland’s “underspend” was only £150 million. If you think you can plan a budget better than this then please, send it in. If not, might be a good idea to stop reporting and moaning about underspends.

Paying For It

Another little line that seems to have been added to GERS this year (on page 37) is a breakdown of the annual costs of financing Labour’s PFI and the SNP’s replacement NPD loans. There’s been a bit of a milestone reached there with the availability costs of PFI now exceeding £1 billion per year or over 15% of Scotland’s total capital budget and slated to increase even further over the next decade unless something is done about it. Don’t be surprised if this becomes a major issue for the council elections next year.

Of course and once again you wouldn’t know this if all you did was watch our Great British Broadcaster, the BBC. Their recent “investigation” into PFI couldn’t even bring itself to mention the name of the party which lumped this crippling financial burden on us.

Finally

I could go on. We could nip-pick at details like the mysterious addition to the expenditure budget of net EU contributions (there’s always been an annex discussing this but this is first year it has explicitly been counted in a separate line in Total Expenditure) or notice that for the first time in at least five years our debt interest paid has increased as our UK debt increases have started to outweigh the effect of falling bond yields.

It’s all a shell game though. We know that GERS isn’t nearly as important as people hold it to be nor is it nearly as informative as it should be. It’s not going to change many minds on its own nor does it tell us one single thing about the finances of an independent Scotland. If we want to do that, we’re going to need to build a national budget from scratch, taking into account all of the taxes (existing and new) that an independent Scotland might choose to levy. We also need to have a look again at what Scotland actually needs to spend its money on. Could we use Citizen’s Income to create from scratch a welfare system worthy of the name? Would a Scottish Government able to issue its own bonds on its own debt be able to get a better deal than the one we have right now?

Quite simply can Scotland as a nation see ourselves as better than others would prefer us to be seen?

Thank you for that. A voice of sanity.

LikeLike

GERS…simplified. What doesn’t get reported.

I concur with arthur…sanity begets clarity and vice versa. Thank you.

LikeLike

GERS is a Westminster invention, courtesy of Ian Lang [now a lord, natch].

LikeLike

I think by now we all know Unionist propaganda when we see it.

I would like to know why my country which has so many natural resources, is worse off than say, Malta, Lithuania, Luxemburg, Jamaica, Barbados etc, etc, etc.

LikeLike

The blatant double-standards used here in order to make your argument is astonishing!

Had the GERS showed a surplus in Scotland’s economy I am under no doubt that nationalists would use it as a point for the independent cause and make the most of the figures.

But because it’s the opposite all they do is try to diminish a report that has international recognition and reliability.

And of course, if the figures are showing the “wrong figures” it has to be Westminster’s fault…

Really?

Is this the best you can do to defend your cause?!

Thanks

LikeLike

Sydnei, you’re conveniently forgetting that GERS are our annual accounts, given to us by our London based ONS and treasury, they are guesstimates at best. When we consider that they were ‘intentionally’ created to play Scotland’s true wealth down, it has already been shown that they were a political tool created by Tory Ian Lang [as Dan above correctly points out] IF – by some strange miracle – they happen to show Scotland in surplus, then of course Scotland would ‘make the most of the figures’, And why not? Much in the same way that our UK government/MSM/opposition parties/Unionists ‘make the most of the figures’ to show how poor and reliant we are. That’s why they were created, not to show us we’re more than capable of being independent, but to prove and emphasize just how ‘dependent’ we are on the rUK.

The report is a ‘snapshot’ of Scotland’s fiscal position within the UK, it tells us nothing whatsoever of how Scotland would fare as an independent country, THAT’S why these guesstimates of guesstimates serve no other purpose other than to reinforce Scotland’s dependency on rUK.

LikeLiked by 1 person

Reblogged this on shoolyboo.

LikeLike

Thanks for this. Interesting stuff.

I was curious about Labour’s PFI legacy in Scotland, so I downloaded the UK gov spreadsheet and itemised the PFI contracts in terms of which UK Nation is was attributed to. Excel makes it really easy to do this and adds it up for you. The figures for the years in the GERS table are a little bit off from the figures in that government spreadsheet, but not by much.

The present £1bn cost of servicing Labour’s PFI is going to increase in the years to come, even as the Tories slash Scotland’s budget. For 2020/21 we’ll pay £1.083 billion. For 2025/26 it will be £1.111 billion. That’s not including the NPD stuff. On top of that we also contribute to National PFI projects, such as MOD contracts, etc.

I wish Labour had built the schools, etc, using the billions surplus they had available at the time, instead of handing it all over to Westminster and choosing the PFI route instead. Makes you wonder who the investors who made 45% profits from these deals were. It’s a shame we can’t find out because the trusts are all offshore.

Still, I don’t know what can be done about it now. We will have paid off Labour’s debts by 2042.

LikeLiked by 1 person

Pingback: Government Expenditure & Revenue Stupidity (the other GERS) | A Wilderness of Peace

Pingback: The Price of Independence, and the Value of Independence | A Wilderness of Peace

Pingback: CONSUMED BY THE BLACK HOLE! | Young Team For Independence

Pingback: Claiming Scotland’s Assets | The Common Green

Pingback: Brexit Means…? | The Common Green

Pingback: Beyond GERS | The Common Green

Pingback: Beyond GERS:- A Response to Comments | The Common Green

Pingback: The Common Green’s 2016 Retrospective | The Common Green

Pingback: Beyond The Headlines | The Common Green

Pingback: Beyond the Headlines - Scottish Independence Economy

Pingback: Grim Drama Parked | The Common Green

Pingback: Trading Places | The Common Green

Pingback: Trading Places -

Pingback: We Need To Talk About: GERS (2016-17 Edition) | The Common Green

Pingback: We Need To Talk About: GERS (2018-19 Edition) | The Common Green

Pingback: We Need To Talk About: GERS (2019-2020 Edition) | The Common Green

Pingback: We Need To Talk About: GERS (2020-21 Edition) | The Common Green

Pingback: We Need To Talk About: GERS (2021-22 Edition) | The Common Green