“The standard private equity playbook: jawbone the unions, cut costs even at the price of damaging longer-term success, do a sale-leaseback of real property assets, take whatever public money you can get from communities eager to save their industries, and do an “add-on”—the Indiana Glass buy. And collect fees.” – Brian Alexander

This blog post previously appeared in Common Weal’s weekly newsletter. Sign up for the newsletter here.

If you’d like to support my work for Common Weal or support me and this blog directly, see my donation policy page here.

Regular followers will know of our three Policy Podcats (we still miss you Jinx) who were frequent uninvited guests on the old Policy Podcast. Being cats, they’re generally quite picky about the food we buy for them and it took us a while to settle in with a company that they liked. Last month, that company went bankrupt after 50 years of trading and after just a few years of being bought out by a private equity firm.

Private equity is a parasite on the already unwell body that is consumer capitalism. It takes the logic of capitalism to its furthest extreme and is designed to supercharge the extraction of value from a system that is already designed to extract (not create) value.

The version of capitalism that you’re probably thinking of runs something like this. I, a Capitalist with access to some degree of wealth, am able to invest that wealth into some kind of venture. Perhaps I’m particular passionate about the production of widgets and wish for everyone to be able to buy them.

So I build a widget factory, stock it with widget-making machines and hire people to run those machines. I pay people for their time, but ultimately the value I create by buying materials for the widget factory and selling the widgets is mine to disburse as I please. If my factory makes a profit, I make money.

Marx lived in that kind of world and pointed out that while the Capitalist owned the machines, it’s the workers who run them who actually create the value – they are the ones who produce value through their labour. Without their labour, the machines don’t run (though the rise of automation may be changing that assumption).

However, so long as the workers don’t own the capital, they don’t have the power to deploy that capital and thus are ripe for exploitation by those who own but do not labour. Communal ownership – Communism – was his solution to that imbalance as workers would share in the risk of the business but would also share in the power granted by it too.

It has been shown even in today’s world that worker ownership of businesses in Scotland results in better working conditions, better worker morale and higher productivity. We don’t live in a mostly Communist world though and so Capitalism ended up moving to the next stage in its development.

You see, while I, the Capitalist, can make a fair bit of money by building a widget factory then buying and selling widgets, that’s still a lot of work and a lot of risk. Under market capitalism, other people can build widget factories and maybe their widgets are better than mine, or cheaper, or they have better advertising and they end up selling more than I can.

It would be faster and easier to look for someone who has already built a factory and buy it from them. Maybe I could buy several and merge them together. If I buy ALL of them, then I have a monopoly and can control the market. Even if I don’t get all that way, then I can at least split the market between as few of my friends as possible and we can fix prices together.

Capitalists have always hated “free markets”. What they want are cartels and monopolies. This is how we get the situation where, for example, virtually all luxury sunglasses – regardless of their “brand” – are owned by the same company.

“BlackRock owns about 5% of just about every company on the planet that issues enough shares to attract its attention.”

But what if there’s an even faster way to wealth? We could, for example, not own a single factory but instead buy a small share in all of the factories. Not enough to need to bother with the responsibility of actually doing anything with them, but enough to extract a small profit from all of them.

Asset Managers like BlackRock and The Vanguard Group make billions this way – BlackRock owns about 5% of just about every company on the planet that issues enough shares to attract its attention. It’s very telling that when the world was very concerned about the monopoly power of the merger of computer software giants Microsoft and Activision, BlackRock already owned shares both of them and so could continue extracting its passive income regardless. That one company extracts about $20 billion every year from the global economy without having to do much to earn it.

But what if there was an even faster way to make a LOT of money? Enter, the world of private equity.

Unlike the more passive actors like BlackRock, private equity firms take a much more active role in the companies they own and to do this effectively, they need to own substantial fractions of them – perhaps owning them outright. Unlike a Capitalist buying out their competition though, they tend to spread themselves across multiple sectors. Crucially, unlike the widget entrepreneur, they are much less attached to the output of the widget factory than they are about the profits they can extract from it. Those profits can and should be boosted as much as possible, as quickly as possible.

And one way to do that is to cut costs – fire half the workers and get the other half to work twice as hard. Maybe even replace them with robots that make widgets of questionable quality, but don’t need to be paid at all. Cut materials. Cut research funding into the future of widget development. You could even take more money from the company than they actually make in profits – get them to remortgage all of their buildings and max out their credit cards then give you a “loan”.

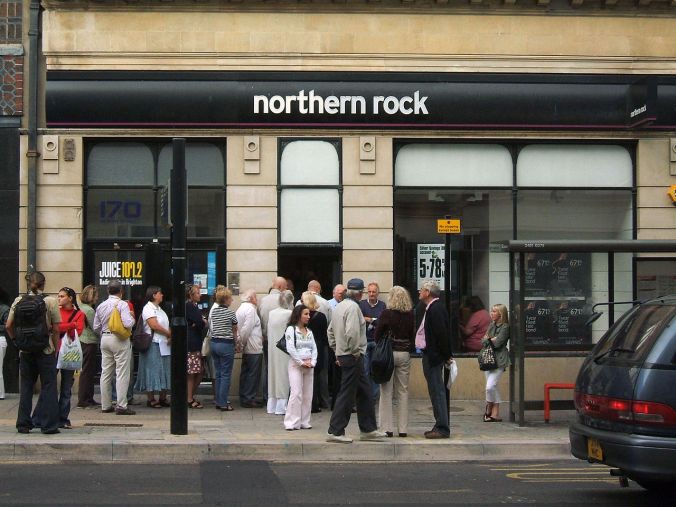

This is why you see so many companies that were previously profitable suddenly start racking up massive debts when they’re bought by private equity. And when it gets too much and the banks start calling in those debts, you can make one last round of profit by firing everyone and selling the company’s assets for parts. What was once a profitable widget factory becomes a debt-ridden shell of itself and collapses.

This is what appears to have happened to the podcats’ food company. There’s a happy ending for them in that we’ve managed to source another company and the picky little furballs are eating it just as happily, but the march of private equity through the ruins of their own making continues.

Scotland needs a better way of managing its manufacturing and service economies. We need more in the way of sustainable and equitable investment. If you saw our daily briefing this week on the warnings about losses at the Scottish National Investment Bank you can see some of what we’d like to see – less parasitic profiteering and more patient finance, so that we can have an economy that works for All of Us, rather than just allowing a few already-rich folk to “win” capitalism at our expense.