“Preserving the difference between “rule of law” and “law for rule” is essential for democracy.” – Pawan Pandit

This blog post previously appeared in Common Weal’s weekly magazine. Sign up for our newsletters here.

If you’d like to support my work for Common Weal or support me and this blog directly, see my donation policy page here.

On Saturday 3rd of January 2026, just a few days shy of the fifth anniversary of his last attempted coup against a government he didn’t like, Donald Trump ordered the invasion and bombing of Venezuela culminating in the kidnapping and extraction of its President. Maduro is an illegitimate ruler, having also ignored the democratic will of his own people, but this does not excuse the US’s breach of international law nor its own domestic laws around the mandate for armed conflict.

Multiple governments now have condemned those actions. Blocs like the EU and UK have restated their commitment to the rules-based international order. None have suggested that the US should face tangible consequences for their actions. Instead, they appear to be nervously looking in any other direction, hoping that the next zebra the lion takes from the herd isn’t them.

In Scotland, the Scottish Government did issue a stronger statement than most – with the First Minister condemning the actions and saying that he did not see how they could be considered legal, but he stopped short of even suggesting any kind of consequences that should be enacted in response.

In a world not too different from ours, all of these things happened too, except the Scottish Government did decide to take action – both to punish the rogue regime that the US has become and to protect the people of Scotland from that regime.

It’s true that the failure of the 2014 Independence Referendum severely curtails the Scottish Government’s ability to acts in geopolitics. Despite promises at the time that Scotland should “lead not leave” the UK, its voice is largely ignored even where it would be quite possible for the UK Government to take advice from devolved nations. Often, not only does this consultation not happen but the first the devolved governments hear about UK Government actions in Scotland is in the newspapers – not even from the halls of Parliament in front of MPs from those nations.

And yet, there are powers that the Scottish Government holds that could be used to respond to Trump’s warmongering.

The first would be direct sanctions. The Scottish Government probably can’t do the traditional sanctions of freezing bank accounts and directly seizing assets (though it should investigate the extent to which it can), but they can be a bit more creative about such things. The Scottish Government could draw up and publish a list of all assets owned in Scotland by members of the Trump regime.

Trump’s own golf course is an obvious one here but there will be other hospitality assets and it’s very likely – given Scotland’s track record in such things – that key personnel will own property, possibly even land and estates, in Scotland.

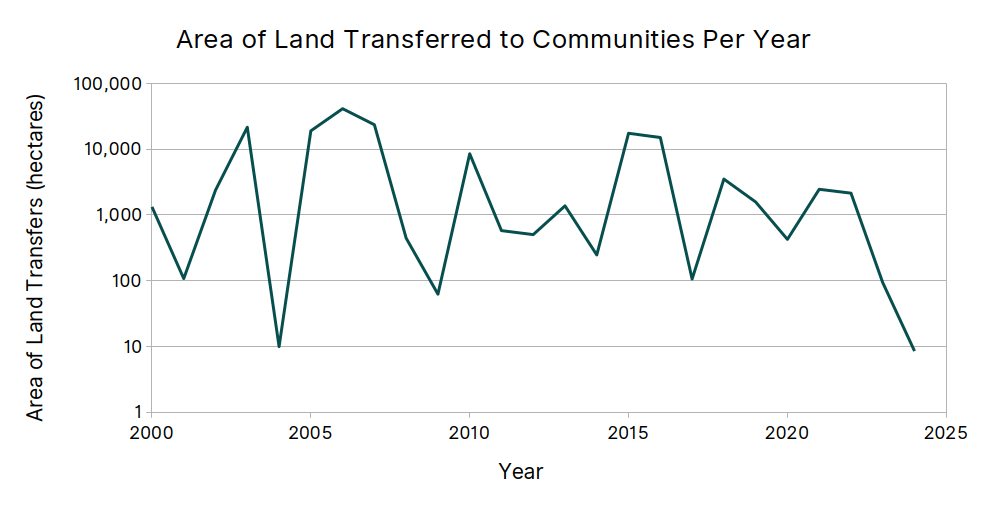

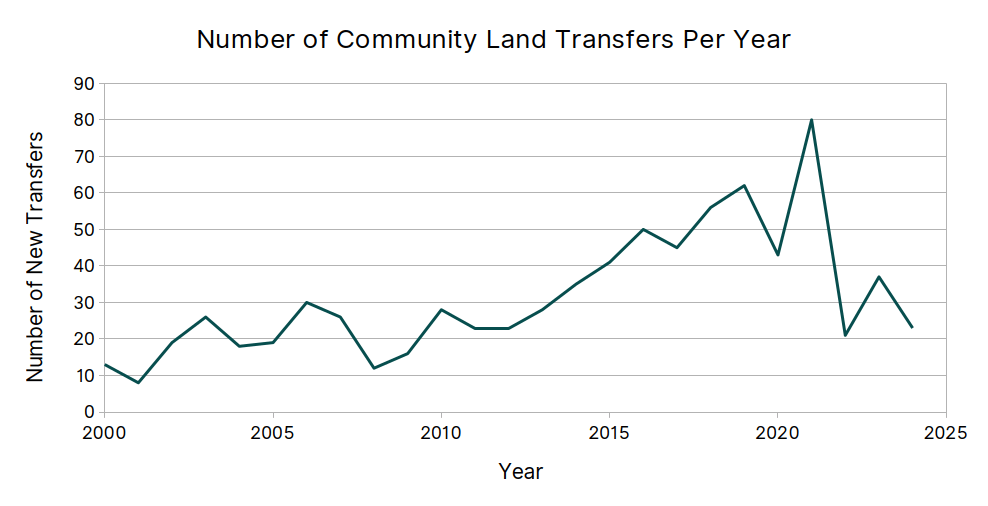

Scotland has the power to enact compulsory purchase of land where doing so is in the public interest and it certainly might be considered to be in said public interest if Trump and his allies no longer own said land. It might even be that given that Trump has recently removed public service provision of golf courses in his own country, then transferring his Scottish golf courses to community ownership in Scotland is merely a part-compensation to the common weal.

There should certainly be no question of Scottish public property being used to aid, abet or support the US’s warmongering efforts. If the Scottish Government can’t close Prestwick, Wick or other Scottish airports they own to hostile or illegally operating US military traffic the way it did for Israeli military traffic in 2024 then officials there should do everything in their power to make it as difficult as possible for the US to use those facilities.

“We no longer live in the world where we can depend on ‘the good guys’ for our security because we can see both how fast they can turn on us and how good they never were in the first place”

The Scottish public sector must pull away from dependence on US tech now. Just as with Chinese involvement in critical Scottish infrastructure such as energy assets and telecom gear, the US’s ability to severely harm the Scottish public sector must now be highlighted.

At the tail end of last year, we saw several large scale failures of IT cloud services that, as far as all evidence points to, were genuine tech failures but one of them – an outage in Microsoft’s cloud servers – went so far as to disrupt the Scottish Parliament’s ability to conduct business. There is no serious question that if Trump so ordered it, Microsoft could deliberately shut down all services to the Scottish Government and our public sector and the Government must now react as if this is just as much a risk to our democracy as if it was discovered that Putin could send the same order to the same effect.

In the short term, back-up procedures must be updated and war-gamed ,but longer term, we must harden our tech sector against malicious attacks like this. The EU is already well ahead of us in this regard with several countries like Germany actively moving their public sector IT over to open source software (switching out things like Microsoft Office to alternatives like the LibreOffice software I wrote this article on).

They are also moving cloud-based software to either self-hosted solutions or secure open-source alternatives with the EU going so far as to start developing it’s own fully sovereign yet completely open source alternatives to storing our critical files on servers located in America and owned by Microsoft and Amazon. (Of course, this does mean that if Scotland doesn’t start doing something like this then we’ll be stuck with choosing between US cloud services or EU cloud services without being politically attached to either which could lead to vulnerabilities no matter the choice).

This will have its economic consequences here too. The public sector and Scottish companies will have to get used to having IT departments again and employing trained staff to secure their systems rather than simply delegating that task elsewhere without taking the responsibility or accountability. But skilled jobs are a good thing for an economy, aren’t they?

Which brings us finally to our economic dependence on unstable regimes like the US. The principle part of this is energy. One of the consequences of Russia’s expansion of its invasion of Ukraine was a drastic realignment of the EU’s energy supply chains (incomplete as it was, painful as it was for the lack of foresight) but much of this has resulted in an increase in imports of US fossil fuels – including to Scotland.

It’s not just the risk of Trump cutting us off that is the primary factor here but the pressure that can be brought on the US simply by opting out of its fossil fuel empire. Unlike previous US expansionism in the Middle East or elsewhere, the recent attacks on Venezuela don’t even have a glossy lie pasted over them to pretend they’re not about oil. Trump is openly boasting about raiding the country for its resources and that other countries will be next.

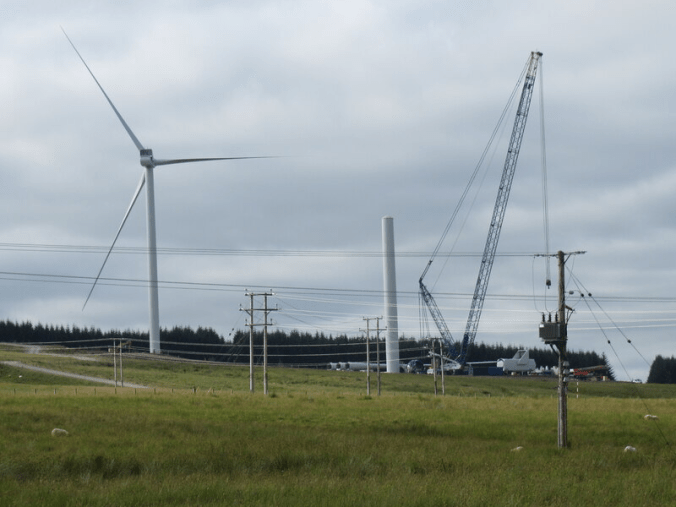

This means Scotland rapidly expanding its own decarbonisation efforts not just to limit our need for US fuels but also to limit our need for fuels in general – if the civilised world follows then basic economics means that over supply and under demand will crash the price of oil and make it economically unviable for the US to do things like invade other countries for their resources. Defanging the oil barons means defanging Trump as well as Putin and other oil autarchs around the world.

At the very least, as we pointed out in our Daily Briefing recently, Scotland and the Scottish Government needs a coherent strategy on foreign affairs. While ‘it’s reserved’, it undoubtedly affects Scotland even down to the use of our public assets and the way in which it makes Scotland a target for adversaries. When we gain our independence we will be cast into the world of having to make the right call on our own and that means building the infrastructure now to be able to start having the discussions on what that call would be.

We no longer live in the world where we can depend on ‘the good guys’ for our security because we can see both how fast they can turn on us and how good they never were in the first place. Common Weal has long advocated for an independent Scotland to take a ‘non-aligned’ stance to foreign affairs. Not necessarily demilitarised and pacifistic – though that’s the goal I personally aspire to – but one where strategic alliances against threats are built based on the merits of their case rather than blind allegiance to a ‘special relationship’ that now offers no protection from our own allies.

Scotland can be a force for justice in the world. Not force in the ‘my might alone makes right’ sense of the bullying superpowers, but by joining with other nations to uphold the rule of law wherever it is breached. Indeed, it’s that rule of law that is the only thing that has ever created some semblance of peace in the world. We give it up at our peril.