“Homelessness is illegal. In my city no one is homeless although there are an increasing number of criminals living on the street. It was smart to turn an abandoned class into a criminal class, sometimes people feel sorry for the down and outs, they never feel sorry for criminals, it has been a great stabilizer.”

–

This blog post previously appeared in Common Weal’s weekly newsletter. Sign up for the newsletter here.

If you’d like to support my work for Common Weal or support me and this blog directly, see my donation policy page here.

Image Source: M J Richardson, CC-BY-SA. The Social Bite Village in Granton, Edinburgh

I’ve been thinking a lot lately about the difference between ‘good’ policies and ‘easy’ policies. There are some ideas out there that politicians find very easy to do, regardless of whether they are good or bad. And some that politicians find very hard to do no matter how much good they’d do.

Universal Basic Income (UBI) is an excellent example of this. As a paper exercise, it looks fairly straightforward. Just find out where everyone is, identify a means of paying everyone and then just pay everyone a certain amount of money regardless of whether they ‘need’ it or not.

It has been shown dozens of times now that these kinds of unconditional cash payments work. They reduce all of the negative markers of poverty, they do it more effectively than ‘means tested’ alternatives, and they do so so effectively that several recent pilots have found that the money granted in the UBI was less than the cost of ‘fixing’ the poverty caused by not having a UBI.

This is a massively ‘good’ policy but it’s not an ‘easy’ one. The challenges of unwinding the existing welfare system – and all of its deliberately punitive negatives – is extremely difficult in the sense that if you happen to miss a month between someone’s last Universal Credit payment and their first UBI payment, then that person could suffer extreme hardship.

It’s hard in the sense of identifying everyone who should be paid and how to pay them – including people who don’t have bank accounts or stable addresses or who may have their finances constrained for any number of reasons. It’s also hard in the political sense that the first reaction from too many who would reach to oppose a UBI is “Why should they get something for nothing?”.

There’s another policy that is pretty much objectively proven now to result in overwhelming positive outcomes, has been shown to be cheaper than not doing it, and will almost certainly get that same final question in response to it – Housing First.

The principle of Housing First is that everyone, regardless of means or circumstance, should have a roof over their head. If someone finds themselves homeless, then this principle means that you don’t wait until support services have deemed whether or not they are worthy of support.

You don’t have the person jump through all kinds of paperwork to prove they need that support. You don’t make judgements on whether or not their lifestyle meets some kind of moral minimum before granting them support. Instead, the first thing you do is provide that person with a house that they can live in for as long as they want at no cost.

You can see the objection immediately. “I pay my rent/mortgage! I didn’t get my house for free!”. Well, I didn’t either, and nor have I had the misfortune of having to sleep rough but I know people who have and I’m well aware that any of us are only one bad day away from having it happen to us.

An excellent paper was published last week by the English think tank the Social Market Foundation that reviews Housing First pilot schemes in Scotland, England, Finland and Canada as part of a campaign to roll Housing First out to all rough sleepers in England and to, in effect, end homelessness.

“In Scotland, it was found that giving someone a ‘free’ house was about £10,000 per person, per year cheaper than just leaving them to sleep on the streets.”

The details of the schemes differ slightly – mostly in whether the house granted to the person is part of a ‘homeless village’ or whether the houses are embedded within communities, but all share the principle that a house is not a reward for taking part in the scheme nor are moral judgements around sobriety or substance use either a barrier to entering the scheme or a cause for eviction. In the words of the Finnish study “dwelling is the foundation on which the rest of life is put back together”.

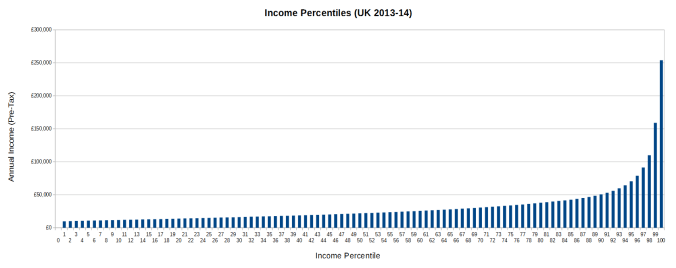

The Scottish examples orbit around the Pathfinder programme that ran from 2019-2022 and found that while the average cost per participant in the programme was around £13,350 per year, the average cost of homelessness was estimated to be about £23,000 per person, per year. In other words, giving someone a ‘free’ house was about £10,000 per person, per year cheaper than just leaving them to sleep on the streets.

Similar levels of savings were found in the Finnish example (€15,000/£12,770 per person per year) and in the Canadian example ($CAD 4,850/£2,611 per person, per year). The SMF estimate that if Housing First was rolled out to as many rough sleepers as is currently possible (i.e. all those who aren’t barred from accessing public funds) then around 9,300 people would avoid sleeping rough and the public purse would save around £178 million.

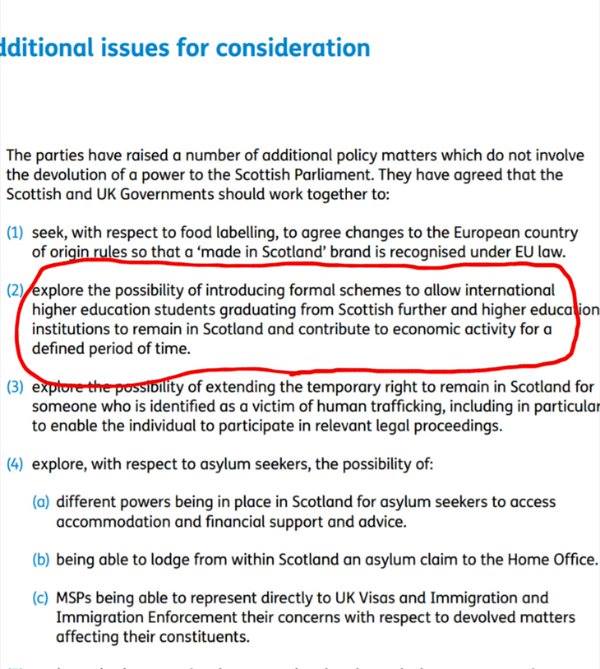

On that subject of people who have no recourse to public funding, they do advocate that this should change. In all the current rancour about migration right now, you might have failed to spot a very obvious flaw in the current system for supporting asylum seekers. In the UK, asylum seekers – those who have claimed asylum from political repression or other forms of discrimination – are barred from working, are barred from many forms of housing and often don’t have their own funds to fall back on.

They are provided meagre housing by the state (getting a room, basic food and a £10 a week is not the High Living that those stoking xenophobia in Britain right now claim it is. If anyone wishes to dispute this point, I challenge them to live for six months on only the means provided to an asylum seeker and write a report of their experiences.)

But they are often turned out of that housing the moment their asylum claim is deemed legitimate and they become political refugees. Without work up till that point, with few support networks around them and without any other fall back plan – it’s no wonder that so many new refugees in Britain end up spending that first night of freedom – or an extended period afterwards – sleeping rough.

Outcomes for those passing through Housing First programmes have almost without exception delivered better outcomes for participants than the services available to them before they entered the programme. In the Scottish programme, more than 80% of participants were still in housing after two years. Not a single participant was evicted from the programme.

In the English pilot schemes, not one participant who left the programme ended up sleeping rough again within the first year. In all of the studies, the mental and physical health of participants improved, they were less likely to commit a crime and less likely to be the victims of a crime.

There appears to be almost no downside of a policy like Housing First and yet I still describe it as politically hard to do largely because of the political cost rather than the financial, moral and social cost of homelessness. This needs to be tackled head on. If it produces better outcomes than existing policies and is cheaper than those policies then it becomes a moral imperative to do that hard thing.

Scotland can end homelessness, end the negative stigma around people who lose the roof over their head, can increase social cohesion and heal some of the divides between us and can do it while saving money. All we need to do to make this happen is to give a homeless person a free house.