And if he is compelled to look straight at the light, will he not have a pain in his eyes which will make him turn away to take and take in the objects of vision which he can see, and which he will conceive to be in reality clearer than the things which are now being shown to him? – Plato, The Republic. Book VII – The Allegory of the Cave

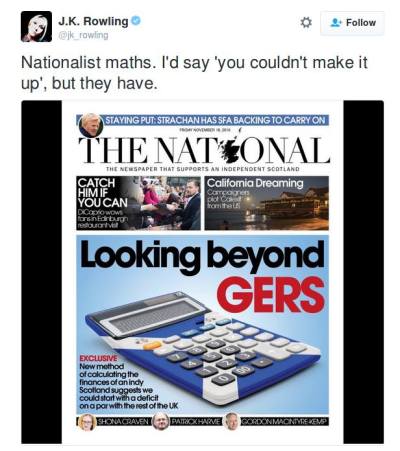

I probably should have foreseen the level of engagement that my latest article for the Common Weal White Paper Project – Beyond GERS – has generated.

Most of it has been positive and the best of the critical response has at least been constructive.

(As flattered as I am by the attention, I don’t particularly include this comment in either of those categories)

Spurred on by the mention of the paper by David Torrance in The Herald, I’ve become aware of several misunderstandings and misconceptions surrounding a few of the comments which have been made so feel that these must be addressed in a constructive manner. This paper represents a large leap away from where the independence debate has stood – more or less stationary – for the past two years so some further explanation of some of the points is warranted.

1. The Data Source is Wrong

This first clarification comes off the back of Kevin Hague’s article here which examines some of the figures used to back my arguments. His chief objection is that I used PESA 2016 (which covers up till financial year 2014/15) as the basis for my disaggregation of UK and Scottish geographic spends and that I should have used CRA 2015/16 instead (and, to his great credit, he makes the case that doing this strengthens our case from a financial perspective). Whilst this is a point to which I would not necessarily object I can only remind that Hague also admits that the latter source wasn’t actually published until after Beyond GERS thus was unavailable at the time of writing and that my conclusion makes it quite clear that this publication should be considered as a first step – to be updated as new data develops.

We must remember that the data for 2015/16 will continue to be updated and refined for several years from now – most of these documents will show refinements and adjustments running up to five years before they “drop off” the table. We must also remember that whilst this study assumes the case of Scotland becoming independent today, the simple fact is that we are not, we will not be and it will be several years at a reasonable minimum before we are. Despite the efforts of some economic analysts to divine the state of the economy several years hence, quite probably the only certain conclusion one can reliably reach on such things is that these predictions will be wrong to greater or lesser degree, one way or the other.

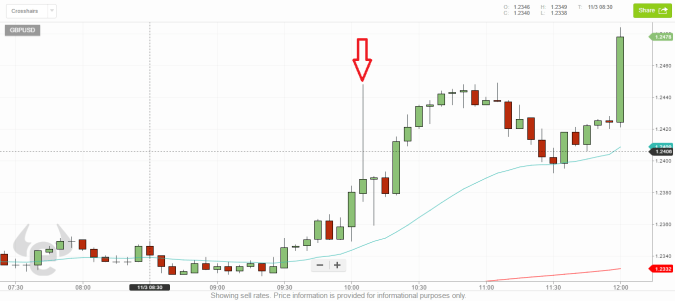

Would using GERS 2014/15 have made for a neater comparison? Possibly. Certainly though the baseline deficit was relatively similar so the task at hand not significantly different. But I’ll give you 20 £Scots to whatever that would be worth in £Sterling that the more shrill objectors I’ve encountered would have immediately demanded to know from where I was conjuring up £1.8 billion of oil revenue.

(Of course, given that the 2016 Autumn Statement is now projecting >£1.5bn of oil revenue per annum in coming years, maybe I could have just claimed extraordinary prescience…)

On one particular point of attention, Hague wonders if I have overestimated the effect of overseas spending to the tune of £2.4 billion. This number was reached via a share of the total UK’s total overseas spend rather than the more modest figures assigned in CRA which applies a “who benefits” formula to spending where possible and a population share where not. The rationale for this choice being that, as outlined in the paper, one of the arguments used directly against Scottish independence was the breadth and reach of the UK’s diplomatic service. Whilst a credible case is made that the UK’s diplomatic service is, while broad, rather more inefficient than it need be I am left feeling comfortable with the idea that others who do not necessarily support independence would now surely recognise that if Scotland wanted to replicate that reach then it would be within our budget to do so. If it’s strictly an overestimate, that’s fine. I’d rather think of it as a potential for investment into Scotland being a genuine force for good in the world.

2. This Means Cuts to Scottish Defence

In two of the cases mentioned, Spending according to the EU average or at NATO target levels, this represents an INCREASE in the amount of spending within Scotland, along with estimations of the economic impact caused by this increase. Only in one of the cases – a level of spend similar to Ireland and in accordance with their policy of neutrality and involvement in UN Peacekeeping missions – would this represent an actual cut to defence. If one were to consider reducing actual in-Scotland spending on defence and were to do it in such a way as to risk jobs – then it would be absolutely right to consider how those savings could be invested into other sectors of the economy which may carry with them far higher fiscal multipliers than defence spending does. As the IMF have noted more than once, rational defence spending levels are rarely decided out of “concerns about the state of the economy“.

This said, defence is an issue which is very much bound up in policy and it is a subject that we really need to have a serious discussion about. Scotland’s defence requirements post-independence are likely to be very different from that of the UK as a whole or even Scotland within the UK.

If, for example, you believe that Scotland’s defence threats are, in order:

1) Nukes from Russia

2) Tanks from Russia

3) Terrorism

4) Troops from Russia

Then you’re likely to end up creating a defence force entirely inadequate at tackling the actual threats to our national security (The top four of which probably look more like: 1) Climate Change. 2) Internal unrest 3) Terrorism. 4) Cyber Attack. None of these need aircraft carriers, outward force projection or nukes to effectively combat). Common Weal will soon be producing our vision of what defence actually means in structural and strategic terms.

3. Closing the Tax Gap = Raising Income Tax

One of the implications made by Hague – and which was picked up by Torrance – was that closing the tax gap to raise an additional £3.5 billion could be equated to a ~30% increase in income tax level. This is a particularly misleading way of representing this particular point, not least because the research quoted in the paper makes it clear that the inefficiencies, loopholes and avenues for avoidance and evasion lie far more within the realms of VAT, corporation tax, capital gains and inheritance tax. The fact that these taxes are all currently reserved to Westminster aside, the implication that closing the tax gap automatically means an increase in tax rates for those who already pay their full share and obligation is simply wrong.

This mode of thinking, I believe, is symptomatic of the main problem that this paper is trying to tackle. Too many political commentators (on both sides of the debate) have gotten far too used to thinking about Scotland strictly in terms of being a wee region of the UK with limited powers. When just about the only major tax power Scotland has control over is income tax, perhaps it’s tempting to think of solutions purely in terms of that one tax but if you want to think about Scotland as an independent country – even if you’re against the idea and want to attack it – you must think about Scotland in terms of BEING an independent country. An independent Scotland would, of course, have full control over all of the taxes currently employed. Most importantly, it would be fully in control of the power and opportunity to completely dispense with the UK tax code and start again with a better, more efficient, more effective one designed explicitly for the Scottish economy. If a pro-Union commentator wishes to fight on this point then they have to be prepared to defend the current UK system, explain away its flaws and why we’re not getting any of the solutions that folk like Tax Research UK can identify as well as attacking any proposals that we push forward.

4. We’d Be Defaulting on the UK’s Debt

The stated objective of the Westminster government in the 2014 campaign was to have the rUK recognised as the “continuing” or, at least, the “successor” state to the United Kingdom (the difference is largely semantic. In the former, the UK would continue unchanged in law but with reduced territory and perhaps a change of name. In the latter, the UK would strictly cease to exist but rUK would inherit all of the rights and obligations of the former state) and for Scotland to be recognised as a “new” state (The link prior went so far as to claim that the 1707 Treaty of Union “extinguished” the country of Scotland as a legal entity despite the UK describing itself to the UN 2007 as being composed of “two countries [Scotland and England], one principality [Wales] and a province [Northern Ireland]“). This state of affairs would carry with it significant advantages for rUK – notably, it would lessen any serious challenge towards their holding the UK’s permanent seat on the UN Security Council which was the case when Russia became the successor to the USSR – but carries with it many obligations also. The historical precedents are clearly laid out and extensively referenced in my paper Claiming Scotland’s Assets but readers should also consider G.F. Treverton’s book on the subject Dividing Divided States.

Essentially, where one country successfully claims “continuing” or “successor” status then it accepts that all of the mobile debts and assets of the former state belong solely to it (non-mobile assets like mineral rights, military bases and public buildings – including public companies and any mobile assets deemed essential to their running – are almost always split geographically). This means that a “continuing” rUK owns all of the UK’s debt in its own name. Scotland can no more default on them than can a former lodger default on your mortgage.

Now, if the side negotiating on behalf of the UK wishes to make the case that Scotland should take on a share of debts, perhaps by offering a share of assets to their value, then this is something that Scotland could consider, accept or refuse. There is a very good case to be made that Scotland doesn’t actually need or want a population share of the UK’s mobile assets. We may need a few £billion worth of military equipment – assuming we can’t buy newer or more appropriate equipment elsewhere. We may need a couple of £billion (those stalwart supporters of independence, Scotland in Union, estimated not more than £1 billion) to set up essential government departments currently lacking – assuming we can’t borrow the money at better rates on the open market. We may need a couple tens of £billions to support our new currency and set up the investment banks we’ll need to start rebuilding our economy. After that, it really does start to become a stretch to consider what other assets we would actually need which would justify accepting over £130 billion worth of debt. Answers on a postcard on that one please.

5. rUK Won’t Pay Pensions to People in Scotland

The current rules regarding the UK state pension are quite clear. If you meet the requirements for one, including paying up to 30 years worth of National Insurance, then you are entitled to a UK state pension when you retire. Should you retire outside of the UK then, depending on which country you retire to, you may or may not receive an annual increment to that pension and changes to things like exchange rate and purchasing power may erode or enhance the value of that pension but the basic premise is laid out. In the absence of an agreement to the contrary, if someone has reached their 30 years contribution before I-Day or has even already retired then they can expect their full UK pension. If, for example, they end up paying 25 years UK NI and then 5 years of Scottish NI (or equivalent) then they can expect both governments to pay according to those shares. If someone lives their entire working life in an independent Scotland then the full share of that pension lies with Scotland. By this logic, at the point of independence, the full component of pension liabilities would fall on rUK as, at that point, no Scottish NI would have been paid.

This should not be a controversial point as this was precisely the stance that the UK government itself took during indyref1 and is entirely consistent with the stance laid out above that rUK would act as the continuing state to the UK.

At least one commentator has suggested that the UK could “change the law at the stroke of a pen” to block payment of extra-rUK pensions. I guess they could. It’d be a “brave” move though. I doubt they’d be able to pass that bill over the howls of horror from all the other British emigrants currently drawing that pension. I’d also love to hear their explanation to both rUK citizens who choose to move to Scotland at some point after independence as well as to their core voting base of those British nationalists who would certainly seek to retain their UK citizenship post independence and may even reject the offer of taking Scottish citizenship to which they may be entitled.

That same commentator also suggested that, rather than a blanket ban on extra-rUK payments, the blockade could be limited solely to Scotland. I find it extremely difficult to suggest a way in which that this could be done which wouldn’t be seen as a blatantly discriminatory attack on pensioners based solely on place of residence.

“You can have your pension paid to you anywhere on the planet*”

*except Scotland

I’m far from a legal authority but I’m fairly sure that one could be challenged in the courts.

Now, if an agreement over pensions liability sharing IS reached then this may change and, being that it is entirely a political negotiation, it’s difficult to predict ahead of time what that agreement would look like. Common Weal will soon be producing our own suggestions about what a Scottish pension system may look like and how it would interact with the rest of the social security network. This may include some form of cash settlement from rUK to Scotland to compensate Scottish residents for the NI they’ve paid into the UK system over the years. More on that in good time.

It is true that the Scottish Government claimed in the Scotland’s Future White Paper that they would take up the pension liabilities. This was part of their stance that Scotland would share UK successor status with rUK and would share assets and debts. Remember that it was the No campaign which originally claimed that this wouldn’t be possible. If this has changed; if the pro-Union campaign wants now to seriously suggest asset and liability sharing. Time to make us a serious offer. We may even agree to it.

6. But the SNP said ‘X’ in their White Paper!

Whether on pensions or currency or any other campaign point this is the comment which, to my mind, represents a total vindication of what Common Weal are trying to achieve through our White Paper Project. That we’ve moved the debate on so much that these segments of No campaign have now flipped from saying that Scotland’s Future was utterly without merit and should be scrapped in entirety to now demanding that its proposals should be accepted in full we’ve revealed that their own case for the Union yet to move on one iota from their position two years ago. They haven’t adapted their arguments to the new circumstances caused, especially, by Brexit and they haven’t even considered the possibility that when they demanded that the Yes campaign drop a previous campaign point and adopt a new one that we might actually do it. They’re still stuck in the Cave, blinking at the light and yearning for the shadows they sneered at two years ago.

Finally

I completely welcome comment and scrutiny of this and other work that we produce. I am more than open to adopting suggestions where they contribute to the project and to updating figures as data are refined or as time moves circumstances on. I shan’t accept some of the more blatant misreadings of this report and I certainly shan’t accept some of the more low-brow comments dismissing this work based on my own academic credentials (as if one is incapable of utilising transferable skills or of ongoing learning after graduation) and as if this is an entirely solo effort with no more thought put into it than a casual personal blog rather than the extensively referenced, collaboratively researched and professionally peer reviewed work that it is.

I’ve often found in this “post-truth” age that those who’ll gleefully tell us not to listen to “experts” when they disagree with them are all too often the same people who demand that we only listen to “experts” when others say the same thing. I’d like to hope that all of us can put that attitude behind us and start discussing the actual issues.