“When two people decide to get a divorce, it isn’t a sign that they ‘don’t understand’ one another, but a sign that they have, at last, begun to.” – Helen Rowland

This article is an expanded version of a paper I wrote for the Scottish Independence Convention in 2021. You can read the original here but this version runs to almost twice the length and includes historical case studies of separations between countries.

Parting Ways – How Scotland and the remaining UK could negotiate the separation of debts and assets.

Introduction

The negotiations around Brexit – and whether they are deemed to be a success or a failure – will no doubt raise once again arguments around how Scotland and the remaining United Kingdom (henceforth “the rUK”) will negotiate their mutual separation should Scotland choose to become an independent country in the near future. Opponents of independence already raise concerns about the potential for those negotiations to be fraught, bitter or too complex to deal with in a timely manner. Unlike the Treaty on European Union, the UK Constitution does not have an equivalent of the “Article 50” within its Treaty of Union and therefore does not have a codified mechanism to provide for Scotland to unilaterally withdraw from the Union (although it does not prohibit such an action either) and nor does it provide a structure for separation negotiations to take place such as giving an explicit trigger to begin negotiations or an explicit time limit within which to conclude them. In some ways, this is to Scotland’s advantage as the Brexit process’s two year time period for negotiations inevitably resulted in higher pressure to conclude the negotiations rapidly rather than well. However, the UK also enjoyed the ability – largely foregone – to simply not trigger Article 50 and start that countdown until a time of its choosing which, had it taken advantage of this, would have allowed the UK to prepare its own negotiating positions ahead of time rather than finding itself at the negotiating table without a clear idea of what Brexit meant.

After an independence referendum or similar democratic event, Scotland will be under immense pressure to begin negotiations almost immediately – the 2014 Scotland’s Future White Paper envisaged those negotiations beginning the week following the referendum – and so it is imperative that Scotland is fully aware of its own rights, responsibilities and asks before these negotiations begin. Scotland must also take the time now, well before a decision to become independent takes place, to plan and prepare so that it does not find itself repeating the mistakes of Brexit and being forced into a disadvantageous deal due to a lack of understanding of what it wanted and what it already had.

This paper is largely an update of my 2016 paper for Common Weal, Claiming Scotland’s Assets, and shall explain the principles of one aspect of those negotiations – the division of debts and assets between separating states – along with a choice of strategies that Scotland could hypothetically deploy as it negotiates its independence.

Principle 1:- Dividing States

Scotland will hardly be the first country to become independent but it will be relatively unprecedented in the sense that in many cases the independence of countries is marked by unplanned and sudden shocks to the political systems, even to the point of outright war. Unlike major societal shifts such as Decolonialisation, the fall of the Soviet Union or the dissolution of Yugoslavia, Scotland’s transition to independence is likely to be one of peaceful and democratic transition even if the political campaigning appears heated compared to recent years. Whilst those prior events will serve to inform (or warn against) the Scottish position with regards to the transition of power and of assets, Scotland itself will almost certainly create new precedents for other nascent states – at least within the framework of the UK Constitution.

Nevertheless, we can still look at historical precedents to determine how states can divide into two or more component states and how this may affect the baseline principles for negotiations between Scotland and the remainder of the UK. Examples of historical events such as the dissolution of Czechoslovakia can be found in the Annex.

Division Type 1 – Separation

Perhaps the simplest form of state division is known as Separation. In this model, one part of the state – usually the largest and most politically dominant segment – simply continues to hold the legal and historical identity of the previous state. It may – but does not have to – maintain the previous state’s name, flag or other trappings of identity but it need not have to. This state is accepted to be either the “continuing” state (whereby the state simply continues to exist as it did before the separation event just with a reduced territory) or it may be the “successor” state which takes on a new name or identity but is considered to be functionally equivalent to the pre-secession state, again though with reduced territory. Treaties, membership of international organisations (such as the UN, EU, IMF etc) and obligations under international law tend to be preserved (though if membership of a treaty is somehow contingent or dependent on something owned by the departing territory then this may be challenged)

A prominent example of a “continuing” state would be the transition of the United Kingdom of Great Britain and Ireland to the United Kingdom of Great Britain and Northern Ireland in 1927 after it accepted the separation of Ireland whilst an example of a “successor” state – explored in more detail later – would be the acceptance by the international community that the Russian Federation would be considered to be the successor to the Union of Soviet Socialist Republics. In practice, there is little distinction between a “continuing” or a “successor” state.

In instances of separation, the new – often smaller or less politically powerful – state is considered to be a new legal entity and must usually apply in its own right for membership of aforementioned international partnerships that it wishes to join or rejoin.

In the case of Scottish independence, it is almost certain that this is the model that will be followed, with Scotland being considered a “new state” and the remaining UK – however it chooses to name or fashion itself – being considered the continuing or successor state to the former UK. There is substantial argument that even if Wales, Northern Ireland or even substantial parts of England (such as Cornwall) joined Scotland in deciding to become independent or join another political union, England itself would remain recognisably coherent enough to be considered the successor to the former UK – so long as the transitions were peaceful, democratic and the result of relatively stable transitions of power. As shall be outlined later, it may be in Scotland’s interest to recognise rUK’s claim to succession.

Division Type 2 – Dissolution

Sometimes the state becoming independent is almost the same size as the state it is leaving behind. Sometimes, the independence event has come about as a result of a civil war or other such breakdown in governance. It may be that the former central government simply lacks the cohesiveness to maintain control of its territory and so many constituent parts of it separate that the remainder is not recognisable as even a rump of the former state. In cases such as this, the former state can be dissolved entirely and two or more new states are formed each with their own distinct break in continuity and subsequent new identities. A relatively peaceful example of this kind of dissolution would be the “Velvet Divorce” of Czechoslovakia in 1993 which resulted in the created of the Czech Republic and the Republic of Slovakia. By contrast, the violent dissolution of Yugoslavia into multiple independent republics stands in sharp contrast.

It is relatively unlikely that Scottish independence will result in the dissolution of the UK – even though a cursory reading of the Treaty of Union shows it to be a Union only between Scotland and England and the state being called a United Kingdom despite the fact that Scottish independence would leave the rUK with only one member nation that would, in fact, be a Kingdom. It may come about if the negotiations between Scotland and the rUK become acrimonious (possibly, but hopefully not, violently so) which results in the international community “punishing” the rUK by not recognising its claim of continuation, reach an impassable stalemate which cannot be resolved by the former separation model or if the socio-political impact of the “loss” of Scotland (and possibly other portions of the UK) causes a fundamental shift in the identity of the remaining state. Such an event would have profound consequences across the world and it is not possible to fully predict the ramifications of this future which may take decades to play out.

Principle 2:- Dividing Assets

Once Scotland and the rUK determine how they will be departing politically (either by separation or by dissolution) then negotiations will commence around various assets (and debts) may be divided. This process will likely set its own precedents to some degree but it can also be highly guided by recent historical events and procedures developed to deal with them. Dividing assets will inherently be as much of a political issue as it will be a diplomatic or legal one which again shows why Scotland must take the time now, well before independence is imminent, to plan for the event. Different types of assets and debts will be split according to different criteria.

Asset Type 1 – Fixed or Immovable Assets

Fixed or immovable assets are some of the most visible government assets but are also, generally speaking, some of the easiest to split. This class of asset includes government buildings, military bases within the separating territory (assuming a separation rather than a dissolution), buildings belonging to nationally owned or public companies, mineral assets such as metals, land or oil as well as any technically movable assets that are fundamentally linked to and essential to the running of a fixed asset (vehicles and plant required to run a nationally-owned factory would fall into this category). Fixed assets are almost always divided on geographic principles unless a compelling and mutually agreed case can be made to the contrary. The modern world has somewhat complicated and blurred the edges of some of assets that may be considered immovable however. The Scottish and UK Government has increasingly relied on public-private partnerships to deliver essential government services and one of the consequences of this is that some government buildings such as the new Queen Elizabeth House – in which is based large parts of the HMRC in Scotland as well as being the new HQ for the Scotland Office and the UK Cabinet when they meet in Scotland – which is not owned by the UK Government but leased from a private company.

It is therefore not a simple given that this building would be an asset that could revert to Scottish Government control upon independence but instead may remain as a UK Government liability (potentially, in this case, to be used as the rUK embassy to Scotland) or be subject to a more complex transfer involving the owners and a transfer of the lease to the Scottish Government should such a transfer be desirable. Other fixed assets with the potential to be transferred from one government to another should be similarly assessed in this light.

Asset Type 2 – Movable Assets

Moveable Assets are also fairly visible and important compared to fixed assets but can end up becoming much higher profile in the separation negotiations as they will inevitably involve more in the way of “picking and choosing” which particular assets the various countries either want to have or (sometimes equally as important) don’t want the other to have. It is one thing to mutually agree some defined value amount of assets that the seceding state may be “due” as part of the split (some defined number of millions or billions of pounds worth of military equipment for example) but it becomes very different thing when the state decides that as part of that deal it wants this particular ship or that particular set of fighter jets as part of its “share”. The moveable military assets that an independent Scotland may want from the rUK may well depend on the military stance that Scotland wishes to adopt in its early years as well as on the age and condition of UK military assets at the point of independence. This exact scenario played out when Slovakia turned down its 1/3rd “share” of Czechoslovakian MiG-23 jets in exchange for half of the fleet of the newer MiG-29’s.

Moveable assets usually consist of those assets which can be moved from one territory and generally includes things like military equipment (except fixed military assets such as bases), foreign currency or gold reserves or similar though, as mentioned in the prior section, sometimes an “efficiency” principle can be applied if a moveable asset is fundamentally linked to and essential for the running of a fixed asset.

Some moveable assets also be exempt from transfer if they are declared to be “national” or “territorial” assets if they hold particular cultural or historical meaning to one of the states or – in the case of a dissolving political union – if it can be shown that they belonged to one of the states prior to the political union’s formation.

Moveable assets are almost always split based on some kind of mutually agreed “share”, often based on a proportional basis. The precise calculation of the “share” can be as simple as a population or GDP share but may take on a more complex metric such as the “IMF Key” used in the aftermath of the dissolution of Yugoslavia or the “Belanger-Campeau formula” suggested during the Quebec independence campaign of the 1990s.

Asset Type 3 – Intangible Assets

(Source: Unsplash)

Intangible assets are an increasingly important aspect of separation negotiations are we become an increasingly digital civilisation. This type of asset will usually be split as per negotiation but often on a more ad hoc basis than moveable assets. Types of intangible assets can include citizens’ data (especially data held by those who would become citizens or residents of the new state) but may also include the IT systems that are used to manipulate said data (assuming the new state wishes to copy existing systems rather than create bespoke new ones). It may also include access to or copies of National Archives, licenses for commercial software, and Intellectual Property Rights held by the state. Data laws such as GDPR become important in this area of negotiations (under GDPR, a citizen owns their data, not the state) but Brexit may cause important issues to arise especially if the UK seeks to diverge away from GDPR principles and/or Scotland seeks to adhere to them to remain compliant with EU structures as it attempts to rejoin. It is not inconceivable that in this scenario that the rUK becomes a country that Scotland declares to be incompatible with its data protection regulations and therefore it would no longer be acceptable for the rUK to hold data on Scottish citizens.

When discussing data transfers (especially on matters such as the personal data of citizens or historical archives pertaining to the new states) there will also need to be a discussion around whether the data in question is copied so that both states have access to that data or if the data is transferred from one state to the other without the former keeping a copy. If this includes military data or data with National Security implications, there may also need to be some kind of independent validation process to ensure that no unauthorised copies of data are hidden or kept clandestinely or to prevent data being destroyed to stop one or the other party from obtaining it.

Asset Type 4 – Debts and Liabilities

(Source: Unsplash)

Debts and Liabilities will obviously be the most political aspect of any negotiation but particularly in Scotland where the relative financial position of Scotland with regard to the UK is hotly debated annually in reports such as GERS (Government Expenditure and Revenue Scotland).

Debts can be considered in a similar light as some of the other types of assets outlined above. This is particularly true of “territorial” debts which may be linked to a particular fixed asset that may be located in one or another of the new post-separation states. If the UK had issued debt specifically for a fixed asset in Scotland (perhaps a “green energy bond” specifically issued for the construction of a renewable energy project) then it could be expected to be transferred to an independent Scotland under the territorial principle. Conversely, whilst Scotland may agree to take on a “share” of liabilities that were either not readily identifiable or covered government spending that “benefits” the whole of the old state proportionately (such as debt covering regular government deficit spending). For such proportional debt allocations, the ratio used to calculate the proportion will also prove both critical and highly political as even a small percentage difference in the ratio can translate into many millions of pounds worth of interest payments stretching over decades.

A final point to consider is how the debt transfer will take place. The nature of the separation will prove to be critical here. In a Type 1 separation, the continuing/successor state almost always takes on full ownership of the old state’s debt – a fact acknowledged by the UK during the 2014 independence campaign. The alternative would be to enter complex negotiations with individual bond holders to determine who would wish to have their debt transferred from one state to another (an action that may or may not come with the prospect of the debt being redenominated into a different currency). This option is usually only reserved for cases of a Type 2 Dissolution where the old state ceases to exist and the alternative is to see the debt bonds default and the investor simply losing their investment. Such negotiations can be incredibly complicated and may take years or decades to fully resolve – a fact that further makes the point that it is to Scotland and the rUK’s mutual benefit to negotiate independence amicably and to ensure a peaceful Type 1 Separation where the rUK is accepted as the continuing or successor to the former UK.

If negotiations result in both Scotland and the rUK taking on responsibility for at least part of the UK’s debt or if some kind of monetary settlement between the two states is negotiated then it should not take the form of an actual transfer of bonds from one state to another but should merely involve some kind of agreed monetary transfer and time period. This said, Scotland – especially if it creates its own currency – may offer citizens and companies resident in Scotland the opportunity to redenominate any UK bonds that they hold into an equivalent bond denominated in the Scottish currency in an arrangement separate to the debt and asset negotiations. Such a policy would necessarily take place on a “no compulsion, no prohibition” basis and would see the Scottish Government and/or Scottish Central Bank purchasing the UK bonds in exchange for a similar or equivalent Scottish bond – presumably the offer being made attractive by allowing payments in what would now be the currency of the bond holder as well as a slightly higher interest rate being offered compared to the old UK bond. Such a deal would result in rUK interest payments being made to the Scottish Government/Central Bank and would serve to effectively offset the size of any payments made in the opposite direction until those bonds matured.

Asset Type 5 – Art and Cultural Objects

(Source: Wikipedia)

In the grander scheme of things, this may appear to be a class of assets that sits somewhat lower in priority than the others, especially as the logistics and infrastructure of a newly independent state is not likely to be fundamentally affected by the presence or absence of such objects. However whilst the monetary value of even the sum total of all art and cultural objects in a country may only be a modest fraction of the sum of all negotiable assets, the cultural value of these objects may transcend that monetary value many times over – one need only to ask any nation whose historical and cultural objects currently sit without their permission as exhibits in the British Museum. Objects will range from public art, through art held by public buildings as well as cultural and historical artefacts important to the story of one or more of the states being formed after the separation event.

Transfer and ownership of these objects will often be negotiated on an ad hoc basis and may well prove to be unexpected and significant points of contention in the negotiations. To give a somewhat fancifully and deliberately provocative example, an independent Kingdom of Scotland that breaks with the 1603 Union of the Crowns may well become embroiled in a significant dispute over the ownership of the Stone of Scone – on which the Kings and Queens of the Scots have been crowned for centuries both pre- and post-Union. The remaining UK may or may not contest this claim possibly on the basis that they view it as a significant artefact in the coronation of their own monarchs as well as an artefact that cements their claim of sovereignty over Northern Ireland via the stone’s purported indirect link to the Irish Lia Fáil. However, an independent Republic of Scotland may well take the view that the Stone of Scone is merely a historical footnote and that it stands to gain more by granting it to the rUK in exchange for something else of practical or cultural value to the Republic. Either of these scenarios is likely to provoke significant and justifiable emotional responses among those who have an interest in this artefact which is just one of many that may be considered in the negotiations.

A Note on Pension Liabilities

One important subset of the state liabilities argument will almost certainly be the issues surrounding pensions – especially state pensions.

Broadly speaking, there will be three areas of pension that may be affected by a state separation. Private pensions are essentially private contracts between the pension provider and the client and as such, whilst there may be significant considerations around areas such as whether or not to redenominate the contracts into a potential new currency (such a choice is likely to be offered on a “No Compulsion, No Prohibition” basis and the choice left to the individual clients) or whether the companies involved have to adjust based on legal and regulatory changes (such as Scotland maintaining close ties to EU financial regulations whilst the rUK diverges). These changes, though potentially significant, will take place in the private sector and thus are unlikely to play a role in debt and asset negotiations.

Public sector worker pensions are likely to be comparatively simple to designate. Many will be linked to devolved departments (such as Police Scotland, Scottish NHS and within the Scottish education sector) and thus their liabilities are already part of the Scottish Government budget. Those that are not (such as UK Government civil servants working in Scotland) will likely continue to receive their pension from their former department according to their accrued entitlement. This arrangement is not without precedent even for the United Kingdom with the former public sector workers within pre-independence Ireland and former British colonies receiving their pension entitlements without challenge. Questions over currency will remain (these pensions will likely be paid in the currency of the rUK and thus be subject to relative exchange rates) but these issues are already the case for retired UK public sector workers who live outwith the UK.

The remaining class of pension is that of the state pension. Under the current UK setup, a state pension entitlement is accrued to anyone who pays National Insurance with the maximum state pension generally accrued once someone has paid National Insurance for 35 years (exceptions and caveats apply in some cases). This state pension entitlement is payable regardless of the citizenship of the person paying the tax and it is not dependent on the person remaining in the UK upon retirement (although some factors such as the pension being uprated by inflation annually is subject to bilateral agreements between the UK and other countries and so may or may not apply depending on where the person in question lives).

Assuming there are no changes to this system and assuming that the rUK takes on continuing state status to the UK then it logically follows that people who have paid UK NI will be entitled to a state pension paid by the rUK Government upon their retirement regardless of their citizenship or where they live post-retirement. This would logically extend to qualifying people who live in an independent Scotland post-retirement which is especially clear in the case of those people who have retired before said independence.

Equally clear is the case of the generations of people who live entirely beyond the independence event. Assuming for simplicity that Scotland retains a similar form of state pension arrangement (being based on years of payments into an equivalent of National Insurance) then those who only start paying National Insurance in Scotland after independence will clearly look to the Scottish Government for the handling of their state pension.

The more complicated area will be those people who are living and working in Scotland at the point of independence. In many ways, their situation will remain analogous to the case of someone working for part of their life in the UK and part of their life in another country (in a sense, this is precisely what they will do – just without changing their location geographically). They would stop paying UK National Insurance and start paying the Scottish equivalent and would therefore accrue a Scottish pension entitlement in addition to their UK entitlement. For example, someone who has paid 20 years of UK National Insurance and a further 15 years of Scottish National insurance would be entitled to 20/35ths of an rUK state pension at the legislated rate and a further 15/35ths of a Scottish state pension at its rate (again, assuming that both rUK and Scotland maintained a similar state pension scheme to the current UK one). A more detailed analysis of these scenarios can be read here.

There is, of course, a political dimension to this. The rUK will approach independence negotiations with a view towards minimising its liabilities towards Scotland and part of this may include attempting to minimise state pension payments to former UK residents. Additionally, there is an argument that the respective pension systems can be simplified by handing the Scottish Government the pension liabilities of people in Scotland who fall into that third category of working across the point of independence. Such an agreement would certainly simplify arrangements for the worker in question (particularly if it means collecting a single pension in a single currency) and would have democratic advantages for retirees in Scotland who may be more able to petition the Scottish Government on issues about their pension than they could the rUK Government (though, again, this concern already exists for UK emigrants who do not have the right to vote in UK elections and would thus not be a novel scenario). In this case it would be prudent to use population statistics and actuarial analyses to calculate how much the rUK would be foregoing in pension payments by transferring liabilities in this manner. As the National Insurance payments have already been made by the people in question and the UK has already enjoyed the opportunity to invest or spend that tax revenue (the UK state pension is “unfunded” and no “pot” of pension money exists for future payments) then it may be reasonable for the rUK to make a lump sum payment to Scotland as an “Equivalent” for taking on these pension liabilities.

Finally, there is a social security dimension to these negotiations. If negotiations are fraught or break down and it results in payments being missed then this could result in significant financial hardship for those involved. Even if the rUK retains the liability to pay pensions entitlements accrued to the UK, Scotland may choose to take on responsibility for paying an inflation uplift (should the rUK refuse to do so) or to pay a top-up if the UK pension rate is significantly lower than the Scottish state pension by policy or as a result of currency exchange rate divergences. Further complications may arise if Scotland chooses to adopt a radically different approach to state pensions such as by introducing a Universal Basic Income (which may or may not be reduced to compensate for state pension entitlements) but discussion of complications of that nature lie outwith the scope of independence negotiations and thus this paper.

Appraising a Nation

Before independence negotiations begin between Scotland and the rUK it is vital that Scotland has a full understanding of the assets it has in its possession both to determine what it already has but also to determine what it currently lacks but will either need in order to run an independent state or that it will desire for other reasons.

Beginning under the 1997 Labour government, the UK used to produce a National Register of Assets which catalogued and estimated the value of many of the UK’s publicly owned assets. This program was cancelled in 2010 on the grounds of bureaucratic complexity when David Cameron’s Coalition government came to power leaving the 2007 edition of the Register most recent publicly available audit (the next scheduled date would have been 2013, less than a year from the first Scottish independence referendum and at a time when such a register would have been both deeply instructive and deeply controversial). As it stands, the 2007 register is now over a decade out of date and predates the 2007/08 recession, subsequent bank bailouts and nationalisations, Brexit and the 2020 Covid-19 pandemic and associated recession as well as four Conservative-led governments pushing an “Austerity” agenda based substantially on public asset sell-offs, retractions of public services and outright privatisation of government functions.

It must be said also that the Register itself is not a perfect guide due to how it was created. Individual government departments were left to estimate the value of their assets according to their own methodologies which led to some inconsistencies where one department (for example, a civil service building) would assign a monetary value to certain moveable assets (such as art displayed within it) but another (say, a museum) may assign a low or even zero value to comparable assets held within. Part of this could be explained by the definition of “value” being based on the ability and willingness (or lack thereof) to sell assets to the private sector rather than on the basis of share of ownership of public works.

If the Scottish Government is serious about holding and winning a second independence referendum it should therefore immediately commission a Register of Scottish Assets along with a full review of what a newly independent Scotland would find desirable but is currently lacking (such as a Central Bank or foreign embassy infrastructure). Further, it is recommended that an agreement is signed by both Scotland and the UK that ensures that neither side will act during or after the independence campaign to compromise the infrastructure of Scotland (by transferring or selling off critical assets) and that they will agree that splits shall be based on the state of assets at a defined date (such as one year prior to an independence referendum) so as to prevent one or both parties moving geographically dividable mobile assets (such as military equipment) out of Scotland before negotiations are concluded.

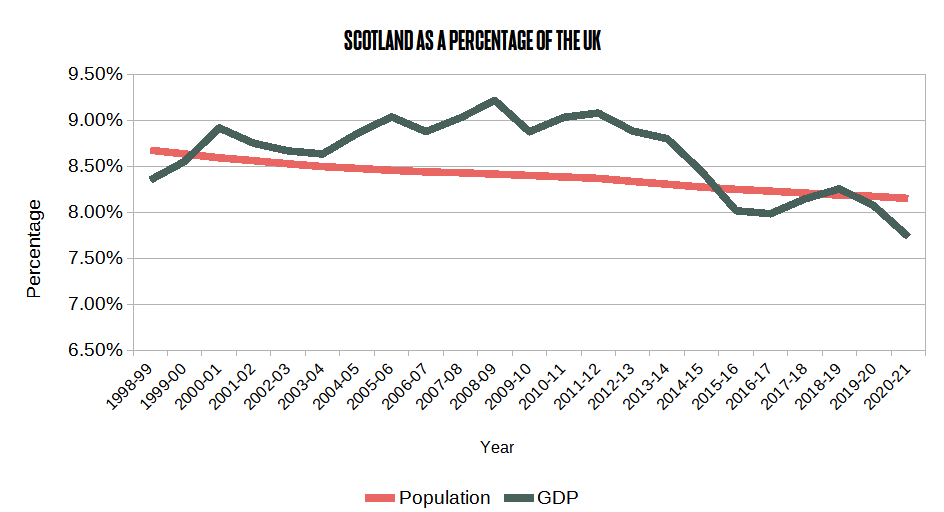

Principle 3:- Calculating Scotland’s “Share”

Once the type and value of assets have been established, it will be important to negotiate a metric for “sharing” any assets (including debts) that are agreed to be split on a proportional basis. As mentioned previously, the precise metric used to calculate this proportion may be a relatively simple one like Population or GDP at or around the time of separation, it may be a more complex metric such as the Yugoslavian “IMF Key” or the Belanger-Campeau formula suggested for Quebec or it may take into account a historical “benefit/contribution” metric.

The historical metric is based on the idea that if one of the new states has received “more” from the Union over the course of its membership than it “contributed” then there is a case that this imbalance should be “paid back”. Obviously, this idea is immediately extremely contentious and highly politically charged but, more practically, it is also extremely difficult to calculate. Adequate records of relative Scotland vs rUK financial data do not exist in a publicly available and contiguous form back to the 1707 Treaty of Union and so calculating whether or not Scotland has been a net beneficiary or net contributor over this entire period is not currently possible. If, instead, a baseline date is set from which adequate data does exist, some kind of historical calculation could be made but the selection of that baseline date would itself be highly politically motivated. Potential dates that have been suggested include 1945 (the end of World War II and the beginning of something akin to the contemporary political era), 1975 (the year that the first North Sea oil pipeline to Scotland began operation), 1992 (the first publication of the annual GERS report) and 1999 (the start of Scottish devolution). Each of these dates are ultimately arbitrary and will result in very different calculations of Scotland’s “net benefit/contribution” to the Union.

Indeed, the idea that Scotland could be a net contributor to the Union at the point of its departure and therefore the agreed fiscal settlement could flow from the rUK to Scotland is likely to be viewed with outright hostility by the rUK negotiators in a way that they would not treat a similarly sized settlement in the opposite direction even if this net contribution could be definitively shown to be the case. The political pressure on an rUK government which agreed to such a settlement to default on this payment is likely to be high and if it is paid, that government’s chances to remaining in office are low.

Ultimately if a proportional financial settlement is agreed then it is more likely that a simpler metric would be used. The following table shows the percentage of negotiable, mobile assets (and liabilities) that Scotland may calculate as a “share” of the UK’s assets based on some of these potential metrics extracted from the annual GERS report.

|

Measure (2020-21) |

Scotland’s Percentage |

|

Population |

8.15% |

|

GDP |

7.73% |

|

Revenue |

7.89% |

|

Expenditure |

9.06% |

As can be seen, whilst these are all relatively similar to each other, they are still different enough that over the totality of the UK’s assets, these differences could run to many hundreds of millions of pounds. If we consider Scotland being allocated a “share” of the UK’s total net debt, for example, then the “proportion” of the UK’s £1.3 trillion net debt could be calculated at anywhere between £103 billion and £119 billion. As we shall see in subsequent sections, the likelihood that Scotland will actually take on anything like this full amount of debt is very low. For the next section, this paper shall assume that a population share is used as a baseline position to underpin potential negotiating strategies with the rUK.

Scotland’s Negotiating Stances

Scotland could go to the independence negotiations with one of several stances which would greatly determine the nature of the assets being transferred. As both Scotland and the rUK are likely to approach the negotiations with an aim to maximise asset gain and minimise debt share, it is important to understand each of these positions so that a coherent negotiating strategy can be constructed.

Scotland’s Current “Share”

Even under the expanded devolution settlement that came into force in 2017, the Scottish government will have only very limited ability to borrow money on its own account, only £600 million per year on the current budget and £450 million per year on the capital budget with total outstanding deficit and debt caps of £1.75 billion and £3 billion respectively. These combined deficit and debt caps are equivalent to 0.7% and 3.0% of GDP. Scottish Local Authorities are similarly limited in the way that they can borrow, with borrowing under several (though not all) spending categories requiring approval by Scottish Government ministers and can be applied to the overall Scottish borrowing cap.

Whilst the UK government also does not readily publish an audit of debts split on a contribution or territorial basis the Scottish annual accounts, GERS, allocates Scotland’s “share” of the UK’s debt and debt interest on a straight population basis (8.15% in 2020-21, with £3.86 billion allocated as Scotland’s “share” of interest paid in 2020-21).

On this population basis, as of 2022 Scotland has been allocated a share of the UK’s gross national debt of approximately £2.7 trillion (which can be reduced to a net amount of around £1.8 billion once debt owned by the Bank of England is considered – effectively debt that the UK Government essentially owes to itself – this figure includes almost all of the money created to spend on Covid countermeasures) amounting to a “population share” of around £220 billion. However, without any detailed territorial audit of debt spent on a territorial basis then Scotland’s actual contribution towards the total UK debt becomes difficult and highly contentious to estimate. One study by the Scottish Government, published in 2013, made the claim that since 1980 Scotland had, in fact, proportionately overpaid into the UK national accounts with an accumulated “comparative surplus” of £222 billion. If these figures are accepted then the difference between a population and contribution share of the UK’s debt could be the difference between an independent Scotland paying money to the remainder of the UK and the reverse transfer taking place. It can therefore be seen that the initial finances of a newly independent Scotland will be highly dependent on the separation agreement reached.

Strategy A:- A Subtractive Share of Assets

This strategy closely mirrors the strategy laid out in the 2014 Scotland’s Future White Paper which states that Scotland would accept a population share of liabilities from the UK if it was also granted a population share of assets. The UK Government countered by claiming that Scotland should take the population share of debts but would not be entitled to any assets at all. If this stance was adopted and maintained by both parties then it would be reasonable for Scotland to subtract the value of any assets that it was denied from the sum of accepted debt. This strategy could also be used when it came to the negotiations around assets that Scotland has no need of (such as Scotland’s “population share” of the UK’s nuclear arsenal). In this case the “cash value” of such assets could be deducted from the debt or transferred to accept more than a proportional share of assets that are more critical to Scotland (such as other conventional military equipment or a share of the UK’s foreign currency reserves).

The significant downside of this strategy is that, lacking a full Register of Assets, Scotland is currently unaware of the assets that it has or would lack upon independence. It is very possible that the sum total of all negotiable assets is far less than the proportional share of debt in question and thus even if the rUK denied Scotland possession of all of those assets, the sum of liabilities apportioned to Scotland would still be considerable even after subtracting the asset value from the debt.

Once Scotland and the rUK have determined how much debt Scotland would take on, a financing plan should be negotiated – including in which currency the debts should be paid. As explained earlier, it is important to avoid the transfer of actual bonds and other debt instruments as this would require negotiations with the debt holders. Instead, Scotland should “refinance” itself by creating and issuing its own bonds to the sum equivalent to the liability accepted. As of early 2020 – just prior to the disruptive events of the Covid-19 pandemic – the UK could reliably issue long-term bonds with an interest rate of less than 1%. If we assume that Scotland would be “charged” a premium on its bonds and thus could borrow at 1.5% (rates substantially higher than this might risk capital flight from rUK to Scotland seeking the higher rates in a country that, whilst new, was still substantially economically sound). If we further assume that the subtractive negotiations are a complete failure and Scotland takes on its full “share” of UK debt with no deductions for withheld assets, then Scotland could be expected to pay around £2.45 billion per year in debt interest payments on its £163 billion debt. This represents a saving of just under £2.1 billion per year compared to the current GERS figures.

Strategy B:- An Additive Share of Assets

Based on historical precedents this scenario is far more likely than the above subtractive case. The UK Government has stated its aim that rUK should be considered the continuing state to the UK and has stated that it would keep full ownership of all of the debts (i.e. would not transfer contracts to Scotland). Scotland should accept and endorse these claims as well as recognising the rUK’s claim to institutions such as the UK’s permanent seat on the UN Security Council and membership of recent trade deals (such as post-Brexit settlements) but would do so in exchange for recognition of its own nationhood, sponsorship in the UN and for an Additive approach to assets and liabilities.

In this strategy, Scotland would seek to negotiate the transfer of critical assets and would effectively “mortgage” their value against an equivalent sum of UK debt. As stated, it is very difficult to calculate the value of such assets without a full National Audit and Asset Register but previous work by Common Weal has tentatively identified around £20 billion worth of required assets. Even if the eventual sum is increased to an entirely speculative illustration of £50 billion then this sum could be “refinanced” in a manner similar to the subtractive case, resulting in annual public debt interest payments for an independent Scotland of around £750 million per year (again, compared to the more than £4.5 billion it is currently assigned).

Strategy C:- An Annual Solidarity Payment.

This strategy was outlined by the 2018 Sustainable Growth Commission. In this strategy, the deal to mutually recognise Scotland and the rUK’s status is similar to the Additive case and the Commission accepts that the rUK shall maintain ownership of the entire sum of the UK’s debt. However, this report proposes that a “proportional share” of assets shall be transferred to Scotland and, in return, Scotland shall pay an Annual Solidarity Payment to the UK amounting to £5.3 billion per year. Of this sum (which also includes a £1 billion payment for “sharing” the UK’s public services and the transfer of Scotland’s entire foreign aid budget of £1.3 billion per year to the UK’s foreign aid departments), £3 billion per year is earmarked as an annual public debt interest payment. This debt interest payment would continue for an “indefinite” time period and would only reduce as a relative percentage of Scotland’s overall GDP as inflation eroded the buying power of the amount and as the Scottish economy grew with time. As no fixed amount of debt would be accepted by Scotland, there would never be a time when it could be said to have been “paid off”. Any attempt to end or modify the annual payments would only be possible by mutual agreement or by a potentially diplomatically damaging unilateral cancellation on the part of Scotland.

This strategy has no historical precedents and would very clearly result in both significant ongoing cost to Scotland compared to other options but would also leave both parties vulnerable to diplomatic strife if one or other state decided to use the payment as leverage at a future date.

Strategy D:- A Zero-Option Separation

If negotiations stall, become acrimonious or the rUK is simply unwilling to transfer or even to sell assets to Scotland then Scotland may wish to enact what is known as a Zero Option Separation. Scotland would cede all rights to transferable UK assets and liabilities to the rUK and would instead build or buy the assets it requires via other means (such as buying in military equipment from willing countries, building its own navy vessels and procuring other assets from various markets). In monetary terms, this scenario would be similar to the Additive case though with the potential advantage of Scotland having more control over being able to unilaterally change the management of the debt at a future date – particularly if it was denominated in Scottish currency. The addition of an independent currency may introduce additional uncertainty around the interest rates charged on the bonds but the author’s previous work, Claiming Scotland’s Assets, has shown that this is unlikely to be significant as bond yields are not significantly correlated to national Credit Ratings until a nation’s rating drops to “Junk” status.

One aspect of this scenario that would be particularly attractive to Scotland would be the control and flexibility it would gain over the types of assets it procured as it would be able to tailor them specifically to Scotland’s needs rather than having to “make do” with whatever assets that the UK had and was willing to give up. This is particularly the case in terms of military equipment where Scotland may be faced with choosing between immediately receiving, say, a naval vessel that is not entirely suited to Scotland’s strategic needs and is already near the end of its operational lifespan versus buying or building a new vessel that is more suited to Scottish needs and (in the latter case) enjoying the economic impact of building the vessel but perhaps having to wait a period of years until it is built and ready for use.

Strategy E:- A “Historical Contribution” Calculation

It is possible that Scotland and the rUK could try to calculate the “historical contribution” that each state has made to the Union over its history though, as stated, the ability to do this is possibly critically impaired by the lack of reliable historical records – at least based on the data that is in the public domain.

Should a “historical” claim be pressed then it is imperative that records are open for scrutiny by both sides and possibly overseen by an independent arbitrator such as the UN or IMF. If reports of Scotland’s “net historical contribution” to the Union are indeed borne out, it unlikely that this will result in the rUK paying a restitution fee to Scotland as would almost certainly be demanded by the rUK if the situation is reversed on the grounds that it is Scotland choosing to leave a continuing state. The argument may hold more weight if the UK is declared to be dissolved and both resulting states are considered “new” and are thus settling mutual accounts but in both cases, the political dominance of the Parliament in Westminster is likely to result in a severe reaction against such a liability to Scotland. Instead, it may simply result in Scotland being able to negotiate a cancellation of any other debt liabilities outstanding after other negotiations.

Conclusion

The issue of debt and asset splits upon Scottish Independence is a sensitive and important topic but it is also one that has been successfully navigated by other countries – some in far more fraught circumstances than Scotland. Previous attempts to lay out a negotiating strategy for Scotland (such as 2014’s Scotland’s Future White Paper and 2018’s Sustainable Growth Commission Report) have not fully considered historical precedents and thus a new strategy for a future independence event should be considered. However, the lack of a Scottish Register of Assets is currently a severe shortfall as it is currently almost impossible to determine what an independent Scotland would need but currently lacks as well as which fixed government assets are actually owned by the public and are thus easily transferable compared to government-used buildings leased from private companies which may therefore be subject to complex transfer negotiations.

Issues where the debt and asset separation may impact payments to residents in Scotland (particularly pensions and social security) must be handled with care to ensure continuity of service even if liabilities are transferred (as even a single missed or delayed payment could result in severe financial hardship for the recipients). Amidst the political rhetoric and gamesmanship inherent to high level negotiations such as this it is important for all parties to reflect on how their words and actions affect the people involved. Behaviour such as threatening pensioners with destitution should they vote a certain way in a referendum is unbecoming of civilised democratic debate.

Nonetheless, all of the plausible negotiating strategies shown above represents clear advantages for an independent Scotland over the current devolved constitution with even the least advantageous (The Annual Solidarity Payment) presenting a scenario whereby Scotland would save around £1.5 billion per year in debt interest payments compared to that currently assigned to Scotland in GERS. Below is a table summarising the negotiating positions detailed above alongside an estimate of the debt taken on by an independent Scotland and the annual debt interest payments made to service it.

|

Negotiating |

Debt Accepted |

Annual Service Payment (£bn) |

|

Devolution |

£218 |

£3.86 |

|

Subtractive |

£218 |

£2.45 |

|

Additive |

£50 |

£0.75 |

|

Annual Solidarity Payment |

£0 |

£3.0 |

|

Zero-Option |

<£50 |

<£0.75 |

|

Historic Contribution |

Unknown |

Unknown |

The most generous scenarios to Scotland – the Additive and Zero-Option scenarios – are also the most generous towards the remaining United Kingdom as either would permit the latter to only transfer assets mutually agreed by both states (rather than an arbitrary amount based on a crude population share) and, perhaps more critically, it ensures that Scotland will accept and endorse the rUK’s claim to state continuity and thus prevent the event of independence becoming more disruptive to rUK’s economy, national pride and geopolitical standing than is absolutely necessary.

Annex:- Historical Independence Negotiations.

Entire books can and have been written on the history of the discussion of the division of assets between states which become independent so it is necessary here to only outline a few examples although it has been observed that most cases of the creation of a new state either involve contentious circumstances, an outright war, unplanned and sudden shocks to the political landscape or the complete dissolution of the previous state. Scotland’s route to independence will almost certainly set its own distinct precedents so the parallels with previous examples may apply only partially.

The Soviet Union

The 1991 dissolution of the Soviet Union resulted in efforts by the largest member state, the Russian Federation, to be considered by the international community as the “successor state” of the former Union, not least because successful adoption of this status would greatly ease questions arising such as the Soviet Union’s permanent membership of the United Nations Security Council. All Soviet foreign debt was claimed by Russia as was ownership of Soviet military assets (USSR successor status, including ownership of all debt, was also been claimed by Ukraine although this claim has been met with far less international recognition). The 1992 Lisbon Protocol between Russia, Belarus, Ukraine and Kazakhstan also led to the agreement that all states other than Russia would relinquish ownership of the nuclear weapons located in their territories and arrange to have them either transported to Russia or destroyed. Ownership of other mobile military assets (i.e. non-nuclear equipment) were transferred on a territorial basis which resulted in Ukraine inheriting far more materiel than it could feasibly use. Additionally, the equipment was distributed such that most of the more modern of the USSR’s materiel was positioned in Ukraine (Russia’s territory containing a greater proportion of reserve and obsolete equipment) but positioned in a manner which reflected the overall strategic concerns of the USSR but not, necessarily, the territorial defence requirements of Ukraine.

One prominent issue which came up during the separation negotiations was the situation in Kazakhstan where the ownership of the Baikonur Cosmodrome was intensely disputed. Kazakhstan sought to apply the territorial principle on what was obviously an immovable asset (some nationalist elements wanted the facility shut down entirely for environmental reasons) whereas Russia, not wanting to lose control of its principle space port sought, to apply a contributive principle seeing as Russian funds had largely supported the facility since inception. A deal was eventually struck between the two nations whereby Kazakhstan would retain sovereignty and legal jurisdiction over the port but operational control would be leased to Russia for the sum of $115 million per year. This “temporary” lease has since been extended several times and currently runs out to 2050. The lesson for Scotland in the story of this base is that is independence negotiations consider the Faslane nuclear base as an asset that can be “temporarily” leased to the rUK then there is a risk that rUK views the financial cost of the lease to be less than the financial and political cost of building a new nuclear base within its territory and even that the Scottish Government may become dependent or unwilling to relinquish the substantial rent it charges, The long term consequences may be that this lease too becomes, for all practical purposes, permanent.

Yugoslavia

It goes absolutely without saying that the violent dissolution of Yugoslavia is a model of state separation to be avoided at almost any cost. It is estimated that more than 140,000 people lost their lives over the course of the resultant wars and more than 4,000,000 people were displaced, many permanently.

Looking at the state of the division of assets and liabilities provides some instruction on what may occur during Scotland’s negotiations. In contrast to the dissolution of the USSR, the attempt by what was then known as the Federal Republic of Yugoslavia (which comprised the states now known as the Republic of Serbia, and Montenegro) to be considered the legal successor to the former state was denied. The Socialist Federal Republic of Yugoslavia was declared dissolved in entirety in September 1992.

This posed a problem for creditors of the former state which, due to the disruptive nature of the dissolution, could not be solved by negotiations between the new states themselves. It was instead left to the creditors to try to apportion what they could to whom. Proportional shares based on population were impossible due to the loss of life and the flight of refugees whereas the war itself rendered the concept of a GDP share entirely academic. This led to the concepts mentioned earlier of “territorial” liabilities, which could be assigned to specific states due to their paying for geographically identifiable infrastructure and “national” debts which could not. Many assets, including military assets, were subject to separate negotiations but of those that were not, the IMF devised a complex ‘key’ which apportioned what remained on a basis weighted depending on each successor state’s population, territorial size, contribution to the federal budget as well as export earnings and benefit from federal expenditure. As a coda, when the Federal Republic of Yugoslavia (renamed the State Union of Serbia and Montenegro in 2003) itself broke up in 2006 following the Montenegrin independence referendum the previous year, the new Republic of Serbia was accepted as sole successor state to the former federal republic although assets and liabilities were split on a beneficiary principle with Serbia taking on 90% of the former state’s debts and Montenegro taking on 10%.

Czechoslovakia

Compared to Yugoslavia or even the somewhat disruptive events surrounding the USSR as a whole, the peaceful dissolution of Czechoslovakia in 1992, often called the “Velvet Divorce”, would provide for Scotland a far more desirable situation in terms of outcome (if not an exact parallel in terms of process) than previously mentioned examples. The emergence of democracy and party politics did show a pattern that would be familiar to Scottish voters looking at the UK of the late 2010s and early 2020s where parties dominant on the Czech side of the federation had little or no presence on the Slovak side of the country and vice versa whilst Slovak parties had little influence in the Czech dominated parliament. Despite a poll placing popular support for dissolution at less than 40% on both sides of the border, an impasse in discussions over whether the country should either fully centralise into a unitary state or further decentralise into a confederal model ultimately resulted in Slovakia declaring independence and an agreement being reached that Czechoslovakia should dissolve entirely.

The division of assets and debts between the two new states was also considered reasonably amicable with immovable assets being transferred territorially and moveable assets being split on a straight population share of 2.29:1 allocated to the Czech and Slovak republics respectively (with some further details and exceptional circumstances being worked out on a territorial or other relevant basis). This said, the negotiations did take a lot longer than is often supposed with the final agreements and transfers taking place some nine years after independence. One issue of particular relevance to Scotland would be the issue of currency. Separation talks were agreed on the basis of a currency union but it was widely acknowledged that due to the widely divergent economic situations in the two new states that such an arrangement would be a short term one, perhaps lasting only a year or two. However, the lack of effective capital controls during the transition period as well as a lack of confidence in the arrangement led to capital flight and a run on the banks (with funds generally flowing from Slovakia to Czechia) which forced the abandonment of the union in only 38 days. The lesson is that proper implementation must be adhered to if any separation negotiations are to be successful.

Québec

Québec is not, as of 2021, an independent state but the intense debate surrounding the constitutional status of the province, particularly in the run up to the second referendum in 1995, led to much discussion over how assets and debts could be split should independence occur. In addition to the population, GDP and beneficiary splits discussed in other cases, a method known as Bélanger-Campeau was also outlined. This method is essentially a variation on the “historical contribution” method where Québec would have taken on a level of assets and debts equal to its contribution to those assets and debts less the value of any federal assets and liabilities acquired (such as Government property and civil servant pensions). The lesson for the Scottish situation is that the baseline measure chosen for any of these “fair and equitable” splits can have substantial ramifications in terms of the actual amount accrued. In Québec’s case, the percentage of Canada’s federal debt taken on by the new state could have ranged between 16.6% under Bélanger-Campeau, through 23.2% for a GDP or 25.4% for a population split up to 32% calculated by the “historical benefit” measure.

Discover more from The Common Green

Subscribe to get the latest posts sent to your email.

Reblogged this on Ramblings of a now 60+ Female.

LikeLike

Pingback: The Unreliable Kingdom | The Common Green

Pingback: What Kind of Scene Are We Setting? | The Common Green

Pingback: Protecting Pensioners | The Common Green

Pingback: Answering Lochgilphead | The Common Green

Pingback: Rolling Over Scotland | The Common Green

Pingback: Extremism Bingo | The Common Green