Just a small sample

But even if they did, we can still do something.

The European Court of Justice has released its judgment of the Scottish Government’s proposals to introduce a minimum unit price on alcohol.

Their judgment, published here, states that the proposals as written would be illegal on the grounds of being discriminatory towards cheap alcohol imports and thus would be a restriction on the free movement of goods within the EU.

They have, however, upheld the Scottish Governments arguments that MUP would lead to substantial health and social benefits and have agreed that it would, indeed, meet the goals of both reducing hazardous alcohol consumption and alcohol consumption in general (in an earlier article I noted that Scottish consumption of alcohol can be seen as substantially higher than the UK average simply by examining the tax records).

The court has therefore not banned MUP completely but has ruled that it cannot be implemented until and unless the national courts (i.e. Edinburgh and then the inevitable appeal to the Supreme Court in London) rule that the same alcohol reductions cannot be achieved via taxation. This sets out a test to be met by the Scottish Government.

But if that test is failed and taxation ruled appropriate, what form could it take?

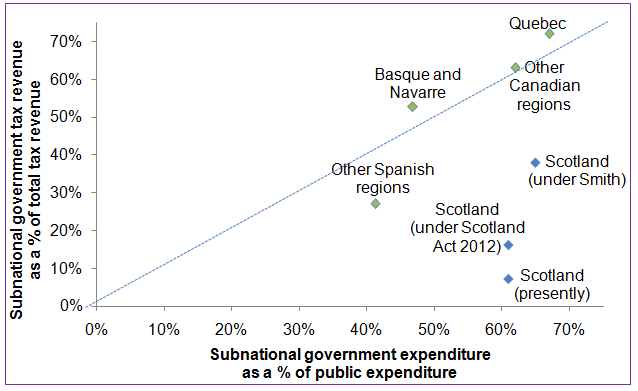

The obvious first step would be alcohol duty but this is currently a reserved power and its devolution was ruled out of the Smith Agreement and the subsequent Scotland Act 2015 Bill. I would think it unlikely, given the current track record, that an amendment to devolve alcohol duty would succeed at this point so I think I’m safe in assuming that it will remain in Westminster hands. Nor, do I suspect, will George Osborne be keen to adjust his own plans for the UK simply to allow the Nationalists even a moment of victory so I can’t see him being amenable to changing alcohol duty at UK level either.

There is another way though, as pointed out by Andy Wightman on Twitter today, the Scottish Government currently DOES have the power to create new LOCAL taxes. If the courts ultimately agree with the ECJ that taxation would be just an effective method of reducing alcohol consumption as MUP then this would be a method within the competence of the Scottish Government to implement without further devolution or delay.

Such a tax need not be set locally, national legislation could fix the rate, though the advantages to doing so are quite strong. By keeping money within areas particularly blighted by alcoholism and alcohol abuse and by allowing the rates to be set to particularly target these areas the greatest good could be done the fastest. Conversely, those areas which perhaps see a lot of through traffic, people traveling into town for a responsible night out say, but suffer little actual harm from chronic abuse may wish to set rates somewhat lower so as to avoid driving away too much business.

While we’re looking at locally devolved alcohol sales taxes we could also take the advantage of the discussion to bring back proposals for alcohol production taxes too. Scotland is perhaps best known for its whisky exports but what is lesser known is the fact that many of the most famous distilleries actually employ comparatively few people and yet produce vast sums of money for their generally multinational corporate owners without doing all that much for a local area which often gives their very name to that drink. Given that these distilleries, and many brewers and other manufacturers, cannot easily move elsewhere (and certainly cannot move out of Scotland) then a local production tax seems particularly apt. Again, by setting it locally and by allowing local people a say in how it is set then they are in a position of power again and can directly benefit from our renowned exports.

Personally, I welcome the prospect of minimum unit pricing and do believe that it would be an effective aid to our national alcohol problem but my challenge to the government is that if the courts rule otherwise, there is still something we can do. Indeed, even if they don’t….why not both?