“Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.” – Dickens, David Copperfield

The shape of the next UK economic crisis has become apparent. It may have already begun and it’s not at all clear how it can be avoided or mitigated.

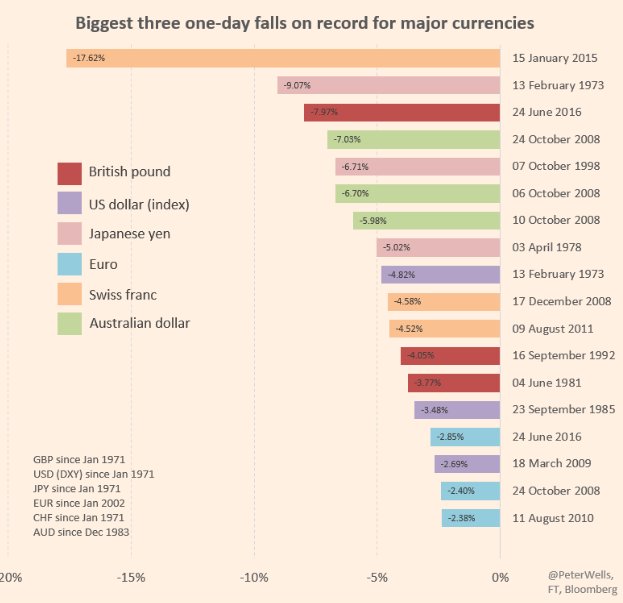

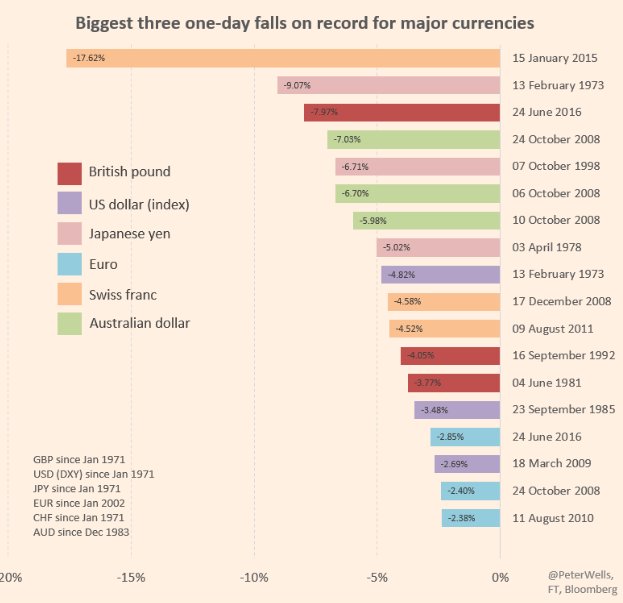

On the 23rd June 2016, the United Kingdom, for a variety of reasons, voted to leave the European Union. The immediate impact of this was an almost unprecedented drop in the value of the pound with respect to its major trading partner currencies.

Not much of a problem, the defenders said, as a weakened currency has its merits as well as demerits. Exports should become cheaper, which would boost foreign trade.

This may have been true in times gone by but economies have grown vastly more complex than this. Many products manufactured in the UK consist of sub-components drawn from multiple countries and globalised supply chains have grown STAGGERINGLY complex.

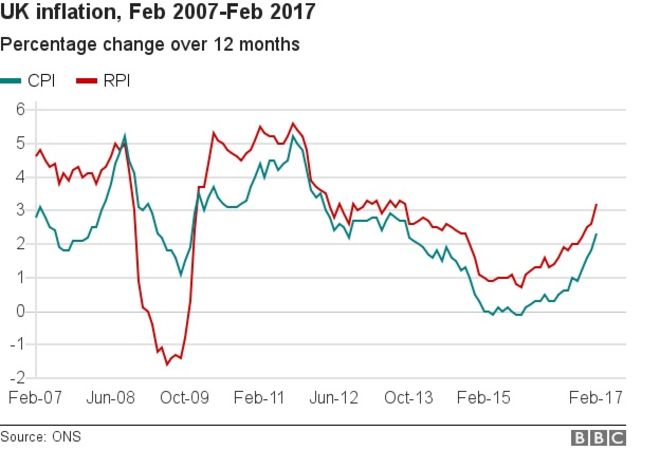

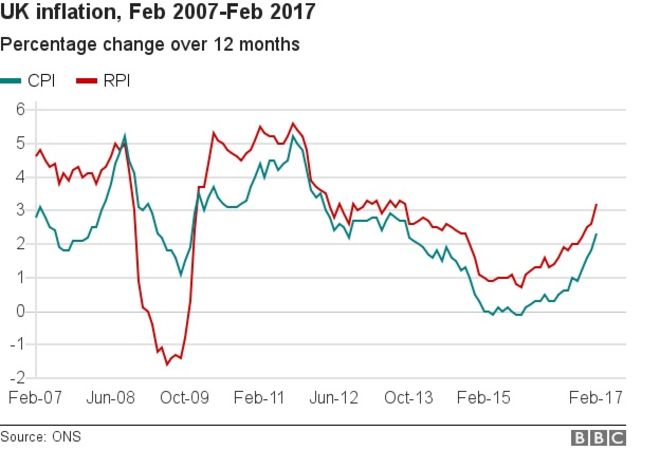

What this has meant is that even the goods that Britain manufactures here have seen their “input prices” increase, which has pushed up the price of goods even despite the fall in currency strength. Add to that, the fact that the UK imports far more than it exports – it has one of the largest trade deficits as %GDP in the OECD – and it becomes clear why prices have started rising again in Britain. After five years of declining inflation rates and almost a year of zero price increases, inflation has returned with a vengeance.

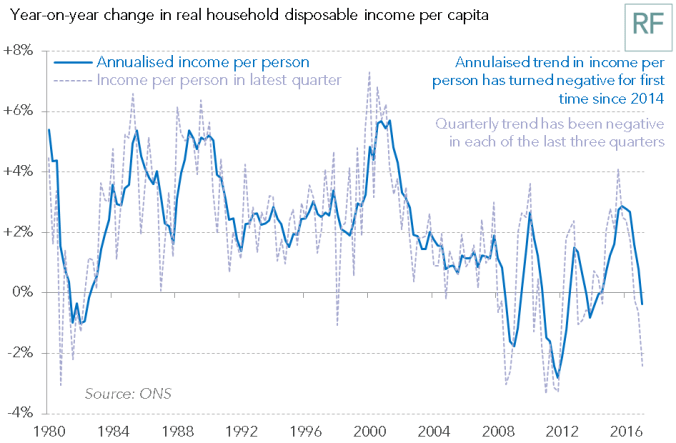

But this needn’t be a terrible thing. In fact, inflation can often be quite useful as it erodes the value of debts (which is why creditors and asset holders hate it so much). So long as wages keep up with the rising prices then for those who don’t depend on the rising value of assets or debts it can be manageable. So how are we doing on that point?

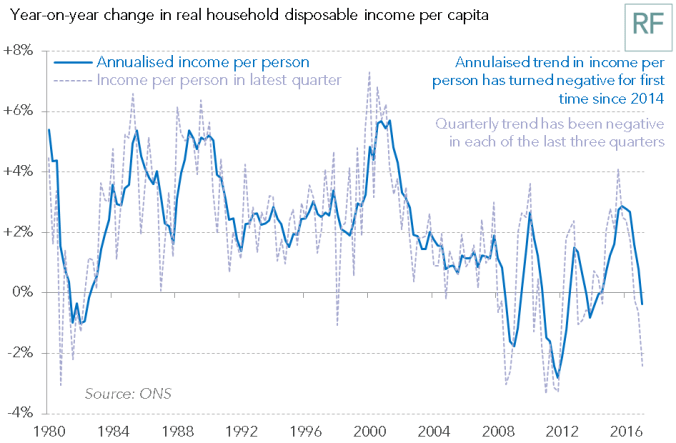

Oh…

We’re not doing so well.

So inflation is rising and wages are declining, so we’re in the situation where meeting our needs and maintain a decent standard of living is becoming more and more difficult. But even this could be mitigated or reversed if the government were to step in and support the economy by investing or by otherwise injecting money into it.

So how’s the UK dealing with things? Well…

And so this is the root of the coming crisis. Prices are rising, wages are stagnating, savings have been drained, credit cards have been maxed out, and the government is pulling out of the business of providing government and public services so you need to spend even more to replace it. We no longer have enough money to meet our basic needs, never mind the disposable income to buy the widgets we need to consume to keep the wheels of the economy turning.

Up here in Scotland, there are signs that the crisis is already upon us. The Fraser of Allander Institute published a report today warning about the precarious nature of the Scottish economy saying that it was stagnating with relation to the UK economy as a whole. Some will almost certainly be quick to blame this on the Scottish government (the phrase “uncertainty of a divisive second independence referendum” comes to mind). There are certainly some things that the Scottish Government could do to help – a National Investment Bank should be high on the list and a good shake up of the domestic agenda would be welcome – but the ultimate cause of this slow-down does not originate in Scotland nor will its solution come from here (at least until the levers of power are returned to the country upon independence).

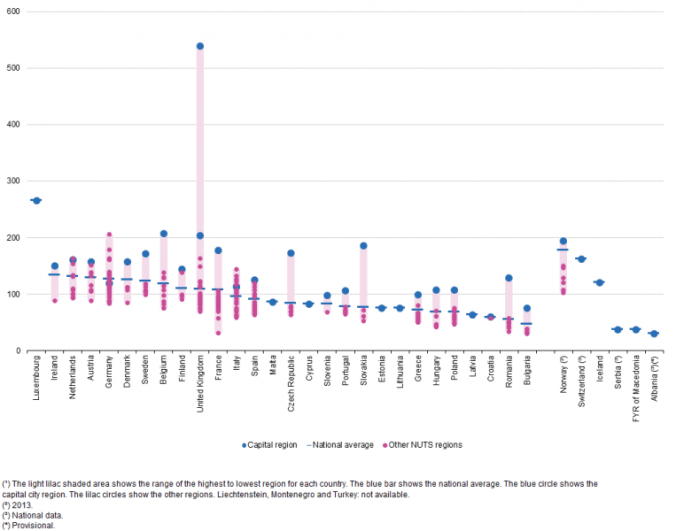

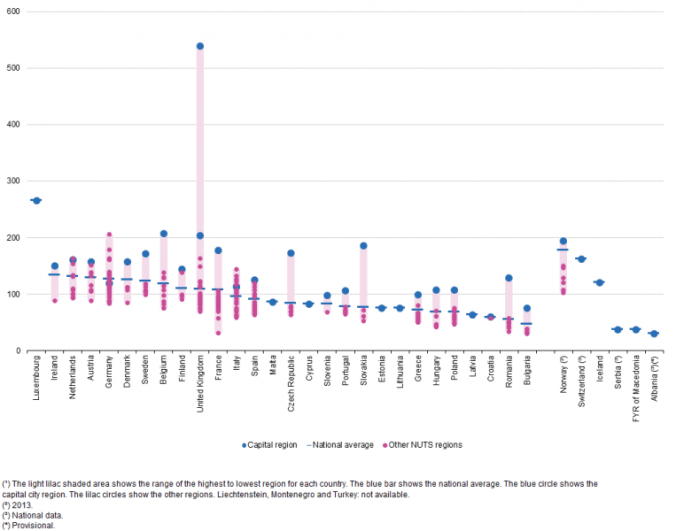

The problem, ultimately, is that Britain isn’t Great. Britain is Weird. Britain is a deeply unequal country on a scale which, compared to its neighbours, is utterly baffling.

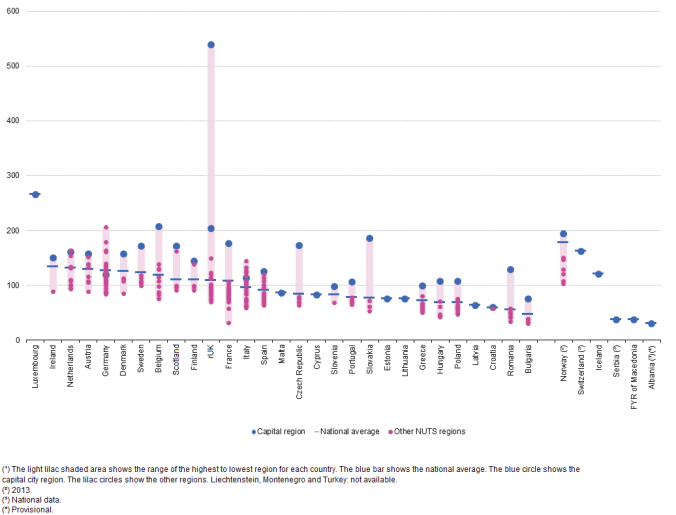

In many countries, the capital city will be the richest region of the nation. This is normal – Money wants to be close to power – but the UK’s disparity really needs to be seen to be believed. Here is the GDP/capita for each of the EU28 and EFTA countries broken down by region. Spot the odd one out.

(Note that the UK has two capital dots. The lower one is London as a whole. The upper one is just Inner London)

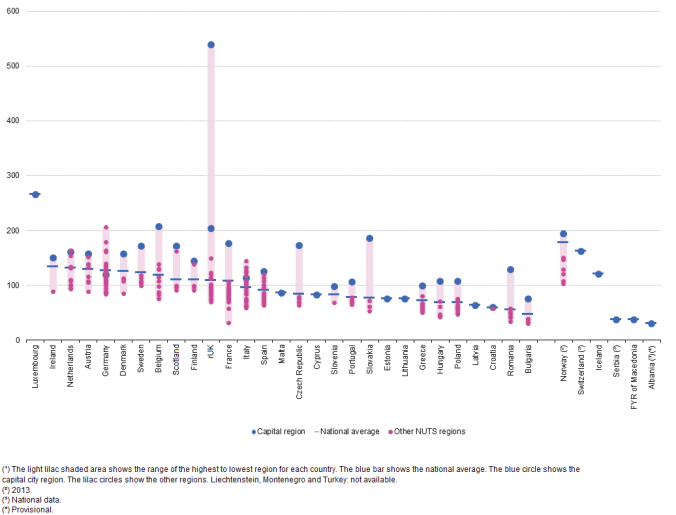

Whenever statistics about Scotland are produced, they’re often given with reference to the “UK average” or the “UK as a whole” but the extreme disparity of Britain masks the picture. Detailed analysis by Prof Mike Danson of Heriott-Watt University has shown that Scotland’s GDP per capita is the third highest region of the UK (after London and the South-East) and, if we were an independent state, we’d be the 9th highest in Europe. In fact, we can disaggregate out the Scottish data from the chart above and catch a glimpse what we’d look like as an independent country.

(Edinburgh data estimated from 2011 NUTS 3 database)

Taken on this view, Scotland no longer looks like a “below average” region of the UK but a fairly normal Western European country. Far more like Finland or Denmark than, say, Greece.

As Prof Danson says, the obsession with comparing Scotland to misleading “UK average” figures leads to commentators ending up unable to take a step back and ask what is happening across and within the UK and where the problems really are. Until this happens, Scotland will continue to stagnate within the UK as the overinvestment of London continues (and is likely to get worse through the Brexit process in a desperate attempt to prop up the financial sector there).

As said earlier, there is a way out of the coming credit crisis but it’s going to involve not more Austerity but a whole lot less. Economists are increasingly coming around to the realisation that the Government’s debt is your surplus and that governments can take on that debt almost without limit (unlike you who have hard limits on credit and the ability to repay it) and – if they have their own currency – can print money in order to provide services (unlike, again, you who would go to jail if you tried that).

Once again, there is a certain amount that the Scottish government can – and should – do at the moment to help but it will always be stymied by the very tight rules of devolution. There’s little to no hope of the UK changing course any time soon (even Corbyn’s Labour is solidly committed to “balancing the budget“) and the hard Brexit the Tories and Labour are both pursuing is being increasingly differentiated by the amount of damage the plans will cause rather than any attempt to prevent it. The Sick Man of Europe seems destined to return to the UK. I only hope that Scotland doesn’t catch its cold.