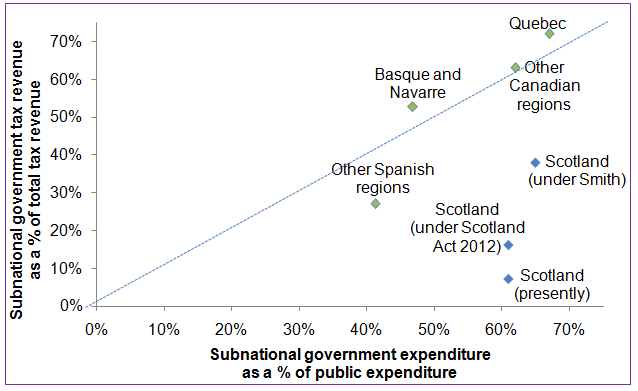

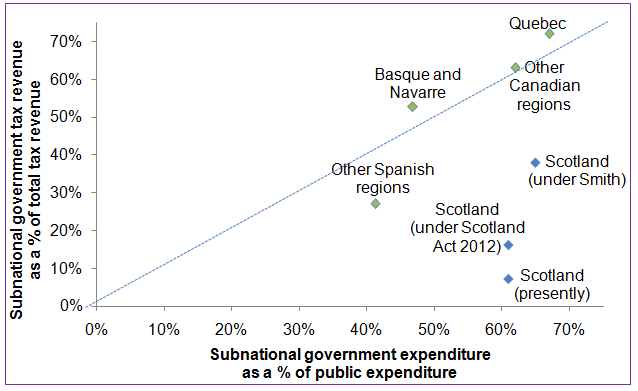

A comparison of the % of devolved control in Scotland now, as it will be under the Scotland Act 2012 and under Smith Commission recommendations as well as a comparison with Spain and Canada. Source: Scottish Government.

Monday the 9th of November saw the Scotland Bill 2015 make a further step towards completion. This Bill, which has been the result of the aftermath of the 2014 independence referendum, will mark another milestone on the devolution “journey” Scotland is traveling upon.

Some of the commentary both during the actual debate in the House of Commons and in the days since have shown considerable confusion at just how the system of devolution in the UK works at the moment and how it is to change with the implementation of the Bill. Before we really settle into a meaningful debate on whether or not any “additional powers” for Scotland will be to and for Scotland’s benefit we need to actually understand what those new powers are, what we have now and how they can be used.

This article shall focus on the powers over taxation devolved to the Scottish Parliament as this area will be undergoing several rapid changes over the next few years and much of the confusion amongst members of the public has arisen from the conflation of several phases of devolution.

One must understand the rather unplanned and piecemeal nature of the progression of devolution for Scotland, there is certainly no clear “destination” to that “journey”, and this reflects and contributes to the confusion but there are three major points in the form of the Scotland Act 1998 which formed the Scottish Parliament after the success of 1997 Devolution Referendum; the Scotland Act 2012 which resulted from the 2007 Calman Commission and the aforementioned Scotland Act 2015 resulting from the Smith Commission of 2014.

Continue reading →