Disclosure and Disclaimer: I am currently standing as a candidate in the council elections. Be assured however that this post shall be objective and party neutral. This is a guide as to how to vote, not to try to convince you to vote for or against any particular person or party.

A Guide to the Scottish Council Elections

One of the most read articles on this blog was a guide written in 2015 which tried to explain the mechanics behind how one votes in the Scottish Parliamentary Elections and how those votes translate into seats. With the voting age in Scotland being dropped to 16 and the upsurge in political interest in Scotland there will undoubtedly be a substantial number of people in the country who will be voting for the first time and will want to know how to do it. This article is for them and those who will be speaking to them in the days to come. As said in the disclaimer, this article will not be advocating any particular choice on who to vote for and will not be discussing options such as “tactical voting”. These are topics for other articles and other blogs.

Background

Scotland is presently organised into 32 regional authorities called councils (some call them “local” as they are currently the lowest level of effective government in Scotland but this would be erroneous as they are many times the size of actual local government in other comparable democracies)

These councils are elected every five years with the last election being held in 2012 under the proportional representation voting system known as Single Transferrable Vote, or STV. The next election is on May 4th 2017.

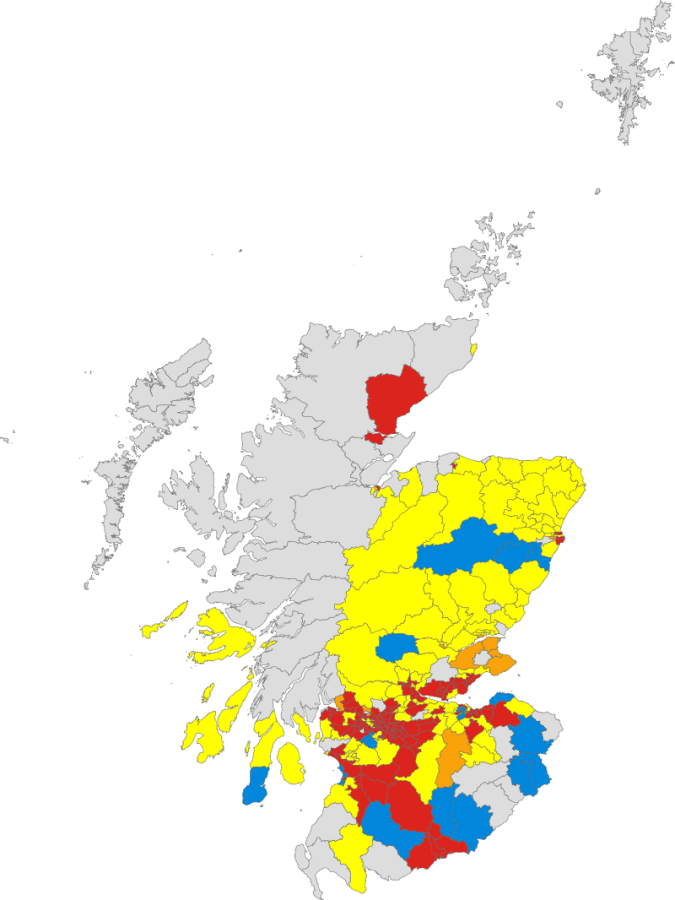

Results of the 2012 elections by highest 1st preference vote in each ward. Yellow – SNP, Red – Labour, Blue – Conservative, Orange – Lib Dem, Green – Green, Grey – Independent

For the purposes of electing councilors, each regional council is split into multiple wards based on the population size of the council. Each ward then elects either 3 or 4 councilors. Due to the relatively small size of each ward and the proportional nature of the vote it is far easier for a non-party “independent” councilor to be elected (often based on either local popularity, past experience in council before leaving a previous party or by campaigning on a particular local issue) than is the case during either the Scottish Parliamentary elections or in the UK General Election.

First: Register To Vote

This is the most important thing. If you are not registered to vote, you cannot vote. There is no “on the day” registration in Scotland and the deadline for the Council elections is April 17th. If you are registered, you are likely to have received a polling card by now telling you where to vote. If you haven’t or if you know that you are not registered, then information on how to do so is here.

How To Vote

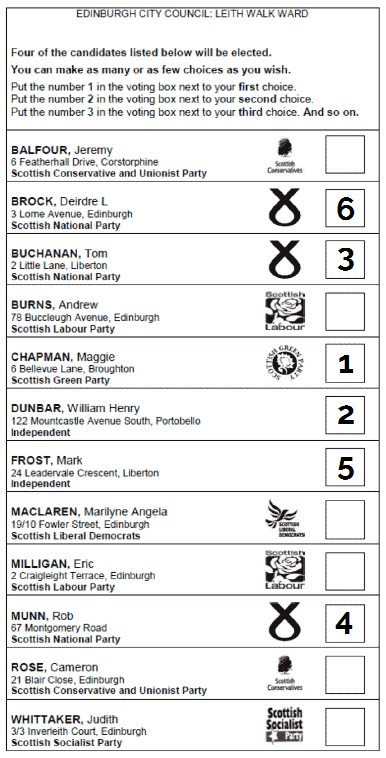

This is the easy bit of STV. Rather than the fairly opaque nature of the AMS system used in the Scottish elections where you are faced with two ballots which are both marked in the same way but are both calculated differently, STV presents you with a single ballot paper which will look a little like this:

The candidates will be listed in alphabetical order by surname with their home address* and their party affiliation, if any, underneath. Also present may be a party logo or a slogan representing a core issue of the candidate/party.

As with the Scottish election constituency vote and the UK General election (but unlike the Scottish Parliamentary Regional vote) you are not strictly voting for a party in these elections but for a person who may or may not be a member of a party. As there may be multiple people standing in a ward representing the same party, it is therefore important to consider the candidate as a person alongside their affiliations.

To actually vote is straight-forward. You do not simply mark one box with an X as with other elections, but instead RANK the candidates in order of preference using a discrete number for each 1,2,3 etc. You may not give two or more candidates “equal” rank. You do not need to rank every candidate. Once you get to the point where you’d prefer none of the remaining candidates to get elected, you may leave their boxes blank. This is sometimes known as “vote till ye boak”. Do not make any other marks on the ballot paper as this may result in your vote being invalidated and rejected. Once completed your ballot paper may look something like this:

Note: Preferences listed here are for illustration only and do not represent an endorsement, recommendation or author’s personal preference.

And once you’ve dropped your completed ballot into the box or sent it away via your postal ballot, that’s it. Simple. The seats are then allocated out such that the candidates elected are the ones deemed highest ranked by the largest number of people

* To be eligible to stand in local elections, one of the requirements is that a candidate must live, own property or work within the council boundaries. Note that the requirement applies at a council level, not a ward level.

The Hard Bit: Counting the Votes

Here comes the tricky part. Counting the votes and translating them to seats. This is a far more mathematical exercise than the FPTP system used in the UK elections (which is trivial. Person with the most votes wins the seats, the party with the most seats wins the government) and more complicated even the d’Hondt system used in Scotland and the EU elections (which can be tabulated with a pen and paper if you have to). If you’re reading this on the front page and want to delve into this maths, then click below to unfold. If not, I hope this has been useful and good luck to your chosen candidate(s) in May.